Over the past decade, mobile money has significantly increased financial inclusion in sub-Saharan Africa. However, the gender gap in access to financial services remains pronounced.

This article examines the potential impact of establishing a National Women’s Bank in Ghana, focusing on financial empowerment, food inflation and poverty alleviation, and the integration of women into the 24-hour economy.

Introduction

Mobile money has transformed financial technologies in sub-Saharan Africa, more than doubling financial inclusion over the past ten years. Despite this progress,

Ghana exhibits one of the widest gender gaps in access to financial services globally. According to the GSMA 2023 Industry Report, both awareness and usage of mobile money among men and women in Ghana have seen substantial growth.

Gender Gap in Financial Access

The Global Findex Database 2021 highlights that 63 percent of women in Ghana now hold formal financial accounts, indicating significant progress in accessing financial institutions. However, the gender gap has widened from 8 to 11 percent over the past five years, underscoring the need to address this disparity to meet the government's financial inclusion objectives.

Furthermore, the World Bank reports that 44 percent of micro, small, and medium

enterprises (MSMEs) in Ghana are women-owned. This sector constitutes approximately 92 percent of all businesses and contributes around 70 percent to Ghana's GDP.

Sustainable Development Goals (SDGs)

Efforts to empower women align with several Sustainable Development Goals (SDGs):

SDG 1: Eradicating poverty

SDG 2: Ending hunger and promoting sustainable agriculture

SDG 3: Ensuring health and well-being

SDG 5: Achieving gender equality and economic empowerment for women

SDG 8: Promoting economic growth and job creation

SDG 9: Supporting industry

Proposal for a National Women’s Bank

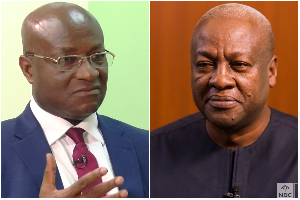

As a public policy initiative, former President John Mahama and the National Democratic Congress propose the establishment of a National Women’s Bank. This institution aims to financially empower one million women, facilitating access to funding for small and medium-scale enterprises (SMEs).

The 24-Hour Economy Vision

John Mahama's vision for a 24-hour economy seeks to create an environment where economic activities—production, services, and commerce—operate continuously, moving beyond the traditional 8-hour workday. This innovative policy will offer tax incentives, affordable and reliable energy, and financial support to businesses operating around the clock.

Addressing Food Inflation and Poverty

The UN World Food Programme reports that 5.5 million Ghanaians—18.4% of the population—lack adequate access to food. Rising food prices exacerbate food insecurity, with monthly food price inflation reaching a 22-year high of 61% in January 2023, consistently exceeding 50% thereafter.

Ghana's challenges with food poverty stem from persistent issues such as inadequate infrastructure and financial constraints. Addressing these bottlenecks through the National Women’s Bank could enhance food production, mitigate inflation, and improve food security, especially in sectors dominated by women.

Impact on Unpaid Domestic Work

The National Women’s Bank can also significantly reduce financial exclusion in sectors reliant on unpaid labor, such as educational infrastructure and domestic

services. Globally, women perform over 76.4% of unpaid domestic work, with this figure rising to 80.2% in developing economies.

In Ghana, tasks such as preparing children for school and managing household chores fall disproportionately on women. By improving access to funding, the National Women’s Bank can empower women to outsource these responsibilities, thereby reducing their unpaid labor.

Conclusion

The establishment of the National Women’s Bank represents a revolutionary public policy initiative that could transform Ghana's economic landscape. By fostering financial inclusion, addressing food poverty, and integrating women into the 24-hour economy, this initiative promises to enhance livelihoods and promote gender equality.

Business News of Monday, 15 July 2024

Source: Shamima Muslim, Contributor