The current happening of the collapse of the five banks namely, The Beige bank, Sovereign Bank, The Royal Bank, The construction Bank (Gh) Ltd and UniBank must be placed squarely on both the internal and external auditors of these banks. It is the foremost duty of the external auditor to express an opinion of the financial statement and also identify any financial misstatement. Internal auditors’ duties include given assurance and consulting service through risk-based auditing to impact on the governance of these banks. These roles are handled by professionals who are supposed to be independent and give an objective opinion, assessment, advice, advocacy and catalyst to both the board, management and the public.

External auditors’ opinion is expressed as fairly presentation, materiality and reported in the generally accepted accounting principles. Audit approach and outcome is affected by four main elements which are enterprise risk, engagement risk, audit risk and financial risk. Enterprise risk affects the operations and potential outcomes of organization activities. Engagement risk comes with an association with a specific client. Audit risk relates to when an auditor provides an unqualified opinion on financial statements that are materially misstated, and financial risk relates directly to the recording transactions and the presentation of the financial statements. Auditor assesses each firms risk based on inherent risk, control risk, and detection risk. The auditors’ independence risk influences these three risks elements.

Independence risk is when auditors are compromised in their assessment, investigation, and assurance and consulting service to objectives and truthfully report on inherent business risk, control risk, and detection risk. Inherent risk relates to vulnerability of transactions to be recorded in error; control risk is the failure of the auditor to prevent or detect misstatement and detection risk is also the failure of the audit procedure to find out material misstatement. It must be noted that the independence risks is the most fundamental and vital asset by the auditing profession. Auditors provide value to capital protecting the interest of both the shareholders and the public.

The auditing professionals in Ghana must bow their heads in shame about this issue because of their independence risk. Auditing firms are focusing on their direct and indirect incentives instead of providing a true and fair opinion. The direct incentives that cause the independent risk are auditing fees, auditors investing in client services and mutual funds, contingent fees, potential employment with both clients and financial dependence. The indirect incentive is the auditing process as involved by a personal or family relationship with the bank. The opinions expressed in their financials statement to Bank of Ghana are all untrue due to independence risk. Even though independence risk can be mitigated by regulatory oversight, corporate governance mechanisms, auditing firms’ policies, auditing culture and individual auditor’s characteristics, the override financial and revenue factors blinded these auditors to raise the alarm to prevent this current situation.

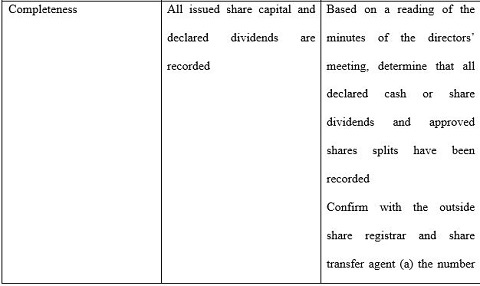

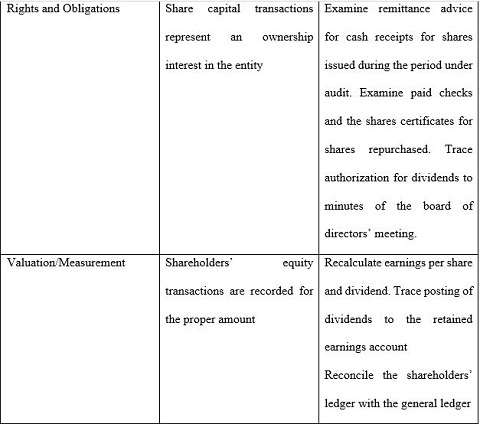

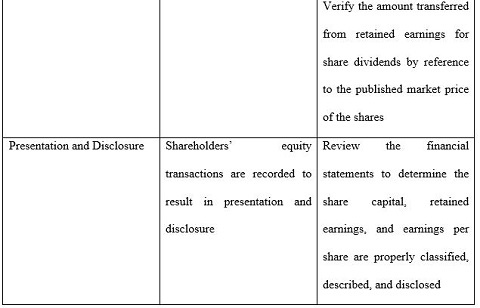

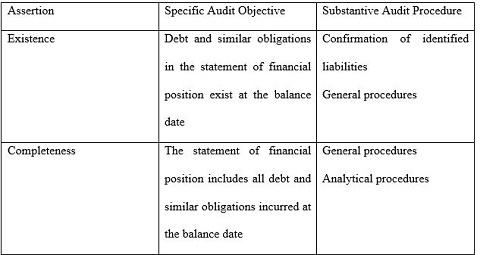

Auditors address the question of how and why. In the current case of the five banks, the problems have been sum up into inherent risk and control risk or equity-related risk and operating risk. In financial management, we will term them as risks of a financial decision and operating decision. Whereas The Beige bank, Sovereign Bank, The construction Bank (Gh) Ltd and UniBank had an issue with equity or capital or financial decision risk, The Royal Bank had an issue with operating risk. Auditing profession has in place a substantive test to be performed which are classified into assertions, specific audit objectives and substantive audit procedures which should have been executed in order to have averted these situations. Presented below this article is the substantive test for owners’ equity and liability as per the auditing standard which the auditors of these banks compromised on to give an unqualified opinion on the financial statements as forward to the Bank of Ghana, Ghana Revenue Authorities and the entire public. These auditors should have obtained sufficient, appropriate audit evidence to support their unqualified opinion. This evidence should have been relevant, indicate sources, and evident hierarchy and objective verse subjective evidence.

The critical question is can any of the stakeholders sue the auditors of these banks for their role in the collapsing of these banks? The answer is YES. This is because auditors have responsibilities and professional liability. It was the duty of these auditors of the banks to have detected material errors which included such things as mistakes in calculations, omissions, misunderstanding, and misapplication of accounting standards, and incorrect summarizations and descriptions. Auditor’s responsibilities for detecting material fraud. Auditors can be held legally liable for actions that represent a failure to perform professional services adequately. A case is cited in the court opinion: Larry Waslow, Trustee for Jack Greenberg, Inc, v. Grant Thorntons LLP; United State Bankruptcy Court for the Eastern District of Pennsylvania, where both the firm and auditing firm were found liable but later settle out of court with the parties. The Judge ruled that the auditors have a responsibility to prevent fraud, but they failed. In the same vein, the auditors of these banks could have helped the Bank of Ghana to in their audit risk (inherent risk, control risk and detecting risk) assessment of these banks and expressed their opinions as qualified or adverse or disclaimer but for their independence risk.

What I think is that it is time for any stakeholder of these affected banks to sue the auditors of these banks for this professional failure. It will serve as a warning and a sit up call for all the auditing firms in Ghana to uphold these professional standards but not to be compromised by the direct and indirect incentives they obtain from their clients. Both internal and external auditors work to assist the regulatory supervision role of the Bank of Ghana. Primarily, it would save the nation the GHS5.7billion bonds to be raised by the government to invest in the Consolidated Bank in order to harmonize the financial sector. As I admit that the Board of Directors, management, and shareholders are all answerable for their roles played in the collapsed banks, I conclude by saying that the auditing profession in Ghana is liable for the GHS5.7billion recapitalization cost. There should be a regulator of auditing firms in Ghana supervising the role and making sure auditors in Ghana comply with their standards.

SUBSTANTIVE TEST OF OWNERS’ EQUITY ACCOUNT

SUBSTANTIVE TEST OF LIABILITY

Opinions of Sunday, 5 August 2018

Columnist: Williams Kwasi Peprah