The global economic balance is shifting toward emerging economies, with alliances like BRICS comprising Brazil, Russia, India, China, and South Africa emerging as powerful platforms for collaboration.

BRICS nations collectively represent over 41% of the global population, command 31.5% of the world’s GDP (PPP), and account for 18% of global trade, making the bloc a significant force in international economics.

As the first quarter of 2025 unfolds, Ghana stands at a pivotal moment to consider joining BRICS and leveraging Islamic Finance as a transformative tool to address its pressing infrastructure needs in roads, electricity, rail systems, and aviation.

By embracing this dual strategy, Ghana could unlock funding, expertise, and partnerships vital for sustainable development.

BRICS membership would offer Ghana unprecedented access to the New Development Bank (NDB), a critical source of low-cost and flexible funding for infrastructure projects. Since its inception, the NDB has approved over $33 billion for transformative initiatives, including India’s solar energy projects and South Africa’s upgraded transport networks.

Ghana could tap into this resource to fund large-scale developments while expanding trade opportunities with vast markets such as China and India, whose combined populations exceed 2.8 billion.

This partnership would position Ghana to increase exports of cocoa, gold, and oil, benefiting from preferential trade agreements and economic collaboration.

Furthermore, BRICS membership offers opportunities for technological and industrial collaboration, particularly in renewable energy, rail development, and smart city innovations, as demonstrated by China and India.

Membership would also enhance Ghana’s geopolitical influence, enabling a stronger voice in shaping global trade, finance, and climate policies. Additionally, it would diversify Ghana’s international partnerships, reducing over-reliance on traditional Western financial systems and offering alternative funding sources.

Islamic Finance presents an ethical and inclusive financial model that aligns perfectly with Ghana’s development needs. With global Islamic financial assets surpassing $3.06 trillion in 2024, the system offers a robust alternative to conventional financing.

Islamic Finance tools such as Sukuk (Islamic bonds), Murabaha (cost-plus financing), and Ijara (leasing) have been used globally to fund infrastructure projects, ensuring accountability by tying investments to tangible assets.

For Ghana, this means potential solutions to its $3 billion annual funding gap in road construction and maintenance, following Indonesia’s successful use of Sukuk to raise over $5 billion in 2023 for highways.

Similarly, Islamic Finance can address Ghana’s energy sector challenges, where $2 billion annually is needed to achieve universal electrification. Malaysia’s $50 billion in Sukuk allocated to green initiatives since 2010 offers a replicable model for Ghana to develop solar and wind energy projects.

Ghana’s rail system, critical for economic connectivity, remains underdeveloped. Countries like Turkey have modernized rail networks using Islamic bonds, raising $2 billion for Istanbul’s third airport rail link. Ghana could adopt this approach to connect key industrial hubs.

In aviation, Gulf nations have utilized Islamic Finance to build world-class infrastructure, an approach Ghana could replicate to establish itself as a regional aviation hub.

Furthermore, Islamic Finance could help address Ghana’s housing deficit of over 1.8 million units, as seen in Saudi Arabia and Indonesia, where Sharia-compliant financing has transformed the housing sector.

The BRICS nations exemplify the transformative potential of Islamic Finance. China, with a GDP of $19.4 trillion and 5.2% growth in 2024, has built over 25,000 kilometers of high-speed rail while integrating Islamic Finance for targeted projects in the Xinjiang region.

India, with a GDP of $3.9 trillion and 6.3% growth, has funded renewable energy and affordable housing initiatives through Sukuk. Brazil’s $2.1 trillion economy, growing at 2.4%, utilizes Islamic Finance for urban transport systems, while South Africa has raised $500 million through Sukuk for energy projects. These examples highlight how Islamic Finance has become a catalyst for sustainable development in diverse contexts.

To capitalize on these opportunities, Ghana must establish a robust policy framework, such as creating a National Islamic Finance House to regulate and promote Sharia-compliant financial activities. Capacity-building initiatives should train local professionals in Islamic Finance, ensuring long-term sustainability.

A pilot program issuing $1 billion in Sukuk could fund key infrastructure projects, focusing on transport and renewable energy.

Strategic partnerships with entities like the Islamic Development Bank, Malaysia, and Gulf nations would attract investment and expertise, while public education campaigns would foster trust and engagement with Islamic Finance initiatives.

As Ghana prepares to navigate the evolving global economic landscape, joining BRICS and adopting Islamic Finance could redefine its development trajectory.

This strategy offers not just immediate gains but also the promise of a resilient, inclusive, and prosperous future for generations to come.

At the Islamic Finance Research Institute of Ghana (IFRIG), we are committed to supporting innovative financial solutions that align with Ghana’s aspirations.

The time to act is now, and the opportunities are vast. Let us seize them together for a brighter tomorrow.

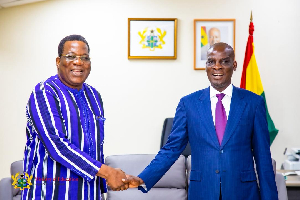

Dr. Shaibu Ali

Director General, IFRIG

January 08, 2024

Opinions of Thursday, 9 January 2025

Columnist: Dr. Shaibu Ali