There have been a number of developments in the international financial system in recent decades that have made finding, freezing and forfeiting income and assets derived from criminal activities more difficult. These are:

1. The use of the US dollar in black market transactions

2. The general trend towards financial deregulation

3. The proliferation of financial havens where secrecy is paramount

4. The progress of the Euromarket

The estimated amount of money laundered globally in a single year is 2% to 5% of global GDP or $1 to $2 trillion in current United States dollars. According to the United Nations Office on Drugs and Crime (UNODC), less than 1% of global illicit financial flows are currently seized by the authorities.

Dirty money is hard to track

The deeper dirty money burrows into the international banking system, the harder it is to identify its origin. According to the KPMG Global Anti Money-Laundering Survey (2014), 92% of financial institutions within the African region state that money laundering is a high risk in their areas and that there is a lack of qualified resources and overall training to address the issue.

This coupled with the increasing financial deregulation, a lack of automated customer risk assessment processes and a requirement for Politically Exposed Persons (PEP’s) to provide evidence for their source of wealth/income create an environment where vast sums of money emanating from the trafficking of women and children, drug smuggling, the illegal sale of arms, the funding of terrorist organisations and other criminal/illegal activities can move anywhere in the world with speed and ease.

Allied to this, the regional and potentially global impacts of terrorism highlight the importance of taking all necessary steps to find ways to deprive terrorist and other criminal organisations of their funding sources. While these organisations are all different in their purpose and nature they all require resources to facilitate and fund various types of activities and to maintain themselves.

One example if the fraudulent movement of vast sums is the former dictator of the Congo, Joseph Mobutu who, alone, is believed to have transferred up to $55,000 million from the country. With the right risk-based and technological frameworks and software in place within the African region, this might not have been possible.

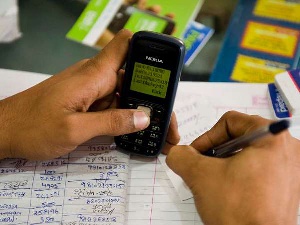

Mobile money services are currently being deployed in many markets across the world including Africa which has embraced them because these services can improve access to formal financial services. However, there are concerns that mobile money services could be used relatively easily for money laundering and terrorist financing. In West and Central Africa, especially, there are very real concerns that these threats could derail hard-won economic gains, undermine future development and contribute to political instability.

GABAC reveals vulnerabilities in mobile finance activities in Central Africa

According to the Task Force against Money Laundering in Central Africa (GABAC), information asymmetries cause several shortcomings in the mobile finance activities in Central Africa. Not all the players listed in the chain of activities are alike and the institution is particularly critical of the attitudes of the banks, as neither they, nor the regulators to which they are linked, are always well-equipped to ensure the compliance of mobile financial activities in operators.

Mobile money transactions present challenges because they traverse previously distinct and independent areas of regulation—most notably the telecommunications and financial banking sectors—often involving multiple ministries and government agencies thus adding to the complexity of oversight needed. These markets also give rise to a number of vulnerabilities in safety and authentication, the need for documentation, and platform integrity issues. Agents and consumers need integrity to perform transactions safely without fear of fraud.

Technology can play a critical role

Integrity covers the people employed across the mobile money chain, the systems as well as the data. Technology can and should play a critical role in ensuring integrity and this is where regulatory collaboration between the central banks and communications regulators becomes paramount. The only transparent, efficient and effective way to combat threats is through technology.

One tech company may have the answer which could assist GABAC and the other organisations working to combat money laundering, fraud and financing of terrorism in Central and other parts of Africa is Global Voice Group (GVG), the global leader in telecommunication governance technologies and financial protection monitoring systems enabling transparency through ICTs.

Countries with the foresight to implement a technological platform to enable the monitoring of mobile money services to protect their economies and security can benefit from GVG’s M3 solution. This consists of a data acquisition and processing system which captures all the transaction data from each mobile money application so that monitoring, verification and analysis can take place.

For instance, in Tanzania, the first country in the world to deploy M3, the Tanzania Communications Regulatory Authority (TCRA) can now monitor how the mobile money market evolves and also the level of compliance with Tanzania’s laws and regulations. Now that the gap in regulation has been closed, Tanzanian citizens can benefit from the financial inclusion that mobile money brings without endangering national security. Properly regulated mobile money transactions have brought in 63 billion TS in taxes to government coffers in the past four years thanks to a secure and efficient telecommunications monitoring system (TTMS).

Imran Farooqi, PwC Partner, Anti-Money Laundering, notes that any organisation that facilitates financial transactions is increasingly coming within the scope of anti-money laundering (AML) legislation worldwide. It is imperative for governments to get up to speed on the requirements they must meet, the required compliance programmes, and to improve their challenges with data quality through the collaboration with ICT partners and the use of appropriate technology.

Opinions of Saturday, 24 June 2017

Columnist: Kate Fieldman