Are we reading or watching the news? No, I don’t think so! We would rather consume patches and shades of organised mental frames about events. Each frame is meant to propel the mind towards a particular sense of meaning and truth.

These frames determine how the media expects society to think about a culture, a corporate entity, an issue, or how consumers should think and relate to a particular brand in a competitive business environment. The function of the media in directing how the public mentally perceives an event or a narrative is referred to as media framing.

In its process, the media employs macro- and micro-framing perspectives on news

events and brand stories. First, macro-framing is about the big picture a story

projects, or, in other words, the context within which the media presents a story or an event.

Microframing, on the other hand, is about specific language choices.

Media employs the implications of the language, the tone of the language, and its invocation of associated mental images. It is therefore worthy of note to know how media framing could influence public perceptions about government and non-government agencies.

This article focuses on how trusted media, such as The Wall Street Journal’s media frames, could throw different shades of public trust into the United States of America’s (USA) federal financial agency. That agency is none other than the Federal Deposit Insurance Corporation (FDIC), which is an independent agency created by Congress to maintain stability and public confidence in America’s financial institutions and systems. (www.fdic.gov)

Significantly, the media’s presentation of media frames around the corporate

culture existing at the United States of America’s (USA) Federal Deposit Insurance Corporation (FDIC) is likely to impact trust, public perceptions, and even direct negative public sentiments towards the FDIC’s brand. Primarily, corporate cultural values form an intrinsic part of a corporation’s belief systems, which subsequently drive growth and sustainable business, and should be guarded and protected from harmful media frames.

The media, as both consumers and workers, remain sensitive to corporations’ ethical cultures for their sense of belonging, trust, working harmony, personal health, professional career development, quality, and ethical service delivery.

Upholding ethical corporate culture remains important as “it shapes everything

from employee engagement to business success” (Rinaily Bonifacio, May 30, 2024)

since a “negative corporate culture can damage a brand’s reputation and loyalty.”

(Jorgen Sunderberg, www.linkhumans.com) and hence perhaps the need for a Wall

The Wall Street Journal’s investigation, which was audited by the Law Firm Cleary Gottlieb Steen & Hamilton on the corporate culture existing at the FDIC, “found out that one in 10 employees at FDIC complained of sexual harassment, discrimination, and other personal misconduct in the workplace” (Wall Street Journal, May 8, 2024)

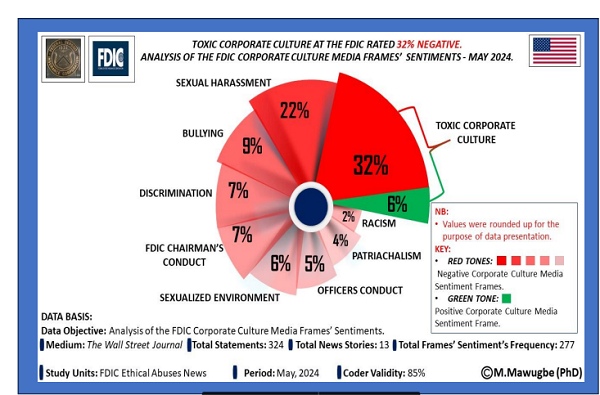

Similarly, how the FDIC’s brand is framed by the media could lead to a reputational deficit or gain among its stakeholders and the general public. It is against the backdrop of corporate culture framing and its possible impact on brand confidence and corporate success This article employed media narrative analysis in analyzing 324 story statements from 13 news articles in the Wall Street Journal for May 2024, while FDIC constitutes the study units. The inter-coder validity of this study is 85%.

The study below revealed the framing contexts within which the FDIC was portrayed before the public, citizenry, stakeholders, and prospective

professionals interested in the FDIC corporate brand.

Framing The FDIC:

Globally, the media acts as an agent for social change. The media’s agenda is

therefore not gratifying itself in publishing negative stories about brands and

organizations, but the media is performing its civic responsibility in the public sphere by mobilizing opinions toward the upliftment of moral and ethical values across all spheres of human life. The media framed FDIC with a high degree of ethical corporate culture abuse, hinging on toxic working cultural values, sexual harassment, a sexualized working environment, bullying, racism, superiors misconducting themselves, patriarchal abuses, and many more, as seen in Figures A and B.

The public’s mental picture of FDIC could be influenced by the media’s frame of the FDIC brand. The frames do not encourage a positive working environment.

Corporate executives are inspired to uphold mechanisms and strategies that seek

to promote a positive working environment and, subsequently, media frames of high civic ethics. Strategic corporate brand story monitoring should be embraced as an effort to manage the brand’s media frames. Media frames should be at the apex of all brand health and brand equity management since they contribute

immensely to the trust the public responses in a brand.

It must also be emphasized that this article’s intent is to contribute to brands’ media frame management without any political intent and should be perceived in the context of understanding how the power of media frames, if not checked, could impact negatively on a brand’s health, sustainability, consumer values, and public trust.

The chart in Fig. A reveals the lingual contexts within which the media framed the FDIC.

The chart in Fig. B reveals the degree of the media frames and their related

sentiments within which the media framed the FDIC.

Opinions of Friday, 5 July 2024

Columnist: Messan Mawugbe

![NPP Flagbearer, Dr. Mahamudu Bawumia [L] and NDC Flagbearer John Mahama NPP Flagbearer, Dr. Mahamudu Bawumia [L] and NDC Flagbearer John Mahama](https://cdn.ghanaweb.com/imagelib/pics/869/86902869.295.jpg)