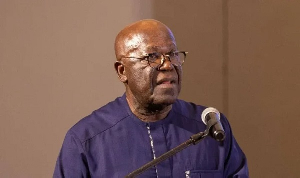

By: Randolph Rodrigues, Head of Investment Banking, Stanbic Bank

Randolph Rodrigues is the Head of Investment Banking at Stanbic Bank. He has extensive experience in the financial services industry and in particular in Mergers & Acquisitions, having previously worked with Credit Suisse and Morgan Stanley in the US as well as in Corporate Finance as a member of the Corporate Development Group at Microsoft.

He attended Cornell University, where he obtained his BA in Mathematics with a specialisation in Economics, and Harvard Business School for his MBA. Randolph returned to Ghana in 2011 as Head of Mergers & Acquisitions at Stanbic Bank before assuming his current role. In this article, Rodrigues shares insight on the right way to prepare a succession plan for one’s legacy.

Yaa Asantewaa, Kwame Nkrumah, The Big 6, 1957, June 4th; regardless of the sentiments that these references elicit when you read about them, they all carry significance well beyond the periods to which they refer. That persistent recollection of their importance by most Ghanaians is what we call legacy.

I sat, undoubtedly like many other people, pondering the ongoing development that was the culmination of arguably the most divisive, most ludicrous, least palatable, elevation to the highest office in the world. The name that blights or graces the West side highway in Manhattan, depending on your perspective of the man – is about to be the most powerful name in the world.

Trump to a large extent represents the exact opposite of everything Obama stands for, from the trivial in his physical appearance to the sophisticated nuance of the detailed profoundness of his approach to policy and political doctrine. It was an absolutely astounding outcome which shocked 60 million Americans and likely the rest of the observing world. Whichever way you look at it, Donald is now the man!

That word legacy sticks out and strikes me with such vigor - perhaps even more so than the crumbling feeling Obama must be experiencing at this very moment. Even more, the trepidation with which I approach this day and contemplate the next, the tentative depressive worry I harbor today when I consider that my 3 year old son will be at least 7 years old and very aware of the world around him by the time the world and America have the next chance to opine on the course of this ship.

This is America, the greatest country in the world! How does this apply to you? Why does it matter what decisions you make today to assure the world after you is as you would have it? Why should you prepare for the next stage (we won't call it the end) possibly even more than you plan for the present? It is because legacy matters - you are what you do and once you're gone, you are what you leave behind.

85% plus of businesses in Ghana are SMEs (Small and Medium Enterprises) and primarily family owned. However this article serves to speak to you, not as one of several thousand companies, but as an entrepreneur, as a business man or woman, as a family person, as a member of society. As you surmount challenges and achieve success in your endeavors, I set out a number of thoughts for you to deliberate on what’s next, on how you preserve the work of your hands – your legacy!

The Business

In Neil Amato’s article “Succession Planning; The Challenge of What's Next,” he suggests that less than 06% of sole proprietorships have commenced any form of succession planning. He goes on to say that when 52% of them were queried as to what they are doing to develop future leaders, they said “nothing.”

It’s not because they don’t care, it’s either because the pressures of the ‘now’ so overwhelm the possibilities of the ‘future’ that no one has the time to pay attention to it, or because we fail to appreciate our own mortality.

Succession planning is the single most important aspect of preserving the credence of your company. It is seldom the case that anyone else can match the passion and commitment with which you have created for your company.

However, it is absolutely possible to find someone with the competence, drive and vision to continue to drive your vision. You may find that individual in your family or outside your inner circle – but you must invest diligently in finding that person as early as you can and subsequently groom them to take over from you – not when you’re on your last embers but when they are ready to take over from you.

The concept of institutionalizing your business refers to the idea that once you have your entity set up and running in a fashion that makes you comfortable, it is time to begin to put in place professional structures to ensure that it is on a sustainable, efficient, world class footing.

In a sense the real reason America will survive or even thrive in a Donald Trump presidency is because their institutions work – no one individual, no matter how powerful can completely usurp the wheel that steers the affairs of the country.

It is important to institute a proper Board with independent, non-executive membership. You need to find the most capable individuals you can with as diverse a skill set and range of perspectives that you can muster and seek their counsel in running your business.

No one doubts you know best what you wish to do; however, you will find that external perspectives can allow you to determine even better ways of achieving your goals while eliminating many of the common pitfalls of entrepreneurial ventures.

Brian Hughes tells us that “for family-owned businesses, strong governance is key to succession planning.” He goes on further to say, “succession planning is often especially challenging due to family dynamics and emotional considerations” and that succession planning “is also an area where independent directors can add enormous value —if they remain objective and maintain the family’s respect and trust.”

Management needs to be incentivized and held accountable. There is nothing wrong with placing your family in positions of authority; however, you need to set them up for success. There should be clear KPIs which they are fully qualified to achieve and they should be rewarded well for (out) performance.

The management team needs to be developed in line with your own plans for exiting the business. Particularly if you are a family business and intend to hand the reins to your children or family members, you ought to invest as much in grooming them as you have in building your business.

You do neither yourself nor them any good if they ascend to your role with inadequate preparation. A combination of academic tuition to learn the technical principles of your operations and on the job training with in-depth immersions in areas across the business will be crucial to ensure they are in a position to take over.

In the next edition, we will look at guarding your finances and, more importantly, your reputation.

To be continued…

Opinions of Wednesday, 18 January 2017

Columnist: Randolph Rodrigues