On August 13, 2024, my attention was drawn to a publication in Graphic Online, titled “Govt faces funding challenge - Treasury bill auctions underperform”.

The basis for this claim was that the government is having trouble raising money on the domestic market after failing to meet its target for the treasury bill for the fifth straight week, raising worries about local investors' declining faith in the status of the economy.

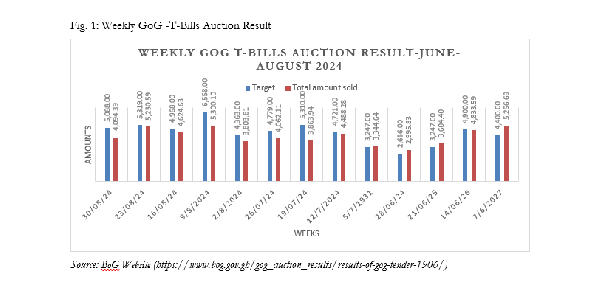

The intended purpose continues, stating that although raising GH¢4.4 billion at the July 12 tender, the government fell short of its aim of GH¢4.72 billion.

With GH¢3.87 billion raised at the July 19 auction, the government fell short of its GH¢5.3 billion goal once more.

In the July 26 auction, the government raised GH¢4.06 billion against a target of GH¢4.77 billion, so things were much the same.

In the August 2 auction, the government raised GH¢3.80 billion against a target of GH¢4.36 billion, falling more than GH¢560 million shy of the desired amount.

On August 9, the previous auction week, the government raised only GH¢5.30 billion, falling short of its aim of GH¢6.55 billion by more than GH¢1 million.

It is understandable that investors, market watchers and capital market analyst are worried when total amount of auctions considered as means of raising short term finances for the government sold are less than the auction target (91,182 & 364) days T-Bills.

Ghana's Treasury Bill (T-Bill) auctions having a total amount sold less than the auction target (91,182 & 364) days indicate that the government's borrowing needs have not been fully met for those auctions.

The government issues T-Bills to borrow money from investors, typically to finance budget deficits or fund specific projects.

When the total amount sold is less than the target, it suggests that the government has not been able to raise its desired amount of funds for those auctions.

In fact, what makes more worrying at this statement is the fact that a further downward trend could pose significant challenges for the government in meeting its financial obligations, especially with the next coupon payment for local bondholders due in a few days.

Weekly targets for GoG T-Bills auctions as against the actual auction sold as contained in Fig 1, demonstrates that on weekly basis, targets for GoG T-Bills auctions exceeded the total amount of auction sold.

The reason for the undersubscription was not a decline in local investor confidence, but rather the government's over-aiming above market demand. Therefore, there would be no appreciable effect on the economy from the T-bill's undersubscription.

To avoid unduly burdening the private sector, we must maintain a careful balance when borrowing on the T-bill market. It would be far better if people and banks were to lend to the actual economy instead of purchasing large quantities of T-bills.

Through the IMF deal and the debt restructuring exercises, several financing options for the government have been unlocked. The Government of Ghana may not be facing significant funding challenges for several reasons.

First, Ghana has been experiencing strong economic growth in recent years, which has likely boosted tax revenues and reduced the need for external borrowing.

Fiscal reforms and improved tax collection measures may have contributed to a healthier fiscal position.

Second, the government has prioritized domestic revenue mobilization through tax reforms and improved compliance.

Efforts to widen the tax base and enhance revenue collection efficiency may have resulted in increased domestic revenue, reducing the reliance on external borrowing.

Besides these efforts, Ghana has benefited from concessional loans and grants from multilateral development institutions, such as the World Bank and the International Monetary Fund (IMF).

These loans and grants often have favorable terms and low-interest rates, providing sustainable financing for development projects.

Again, Ghana's capital markets, including the stock market and bond market, have been relatively active, providing alternative financing options for the government.

The ability to raise funds through equity or debt issuances in the domestic market can reduce the pressure on external borrowing.

Ghana may be benefiting from favorable investor sentiment, driven by positive economic indicators and a stable political environment.

This sentiment can attract foreign investment and improve the government's ability to raise funds in the international markets.

Finally, Ghana's strong relationship with multilateral institutions, such as the African Development Bank (AfDB) and the International Finance Corporation (IFC), provides access to concessional financing for infrastructure projects and other priority areas.

While the absence of significant funding challenges is positive, it is important for the government to maintain fiscal discipline, continue economic reforms, and ensure sustainable debt management practices to maintain investor confidence and access to financing options.

Prof. Isaac Boadi

Dean, Faculty of Accounting and Finance

University of Professional Studies, Accra

Opinions of Thursday, 5 September 2024

Columnist: Prof. Isaac Boadi