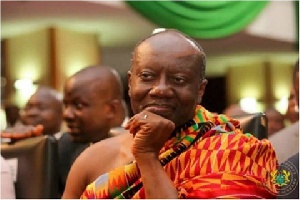

Ghana’s recent positive macroeconomic gains have been achieved on the back of prudent management. Locking-in these gains calls for the enforcement of practices that limit shocks. As Finance Minister, Ken Ofori-Atta, is leading the charge to transform Ghana into a regional financial hub by building robust corporate governance structures based on corporate citizenship is non-negotiable.

Democratic institutions thrive in an environment where there is good governance and good corporate governance is key to strengthening democracy. Transparency, a major good governance practice, both in the public and private sectors, tends to favour taxation, environmental protection, and social responsibility; three elements that drive some of the world’s most successful economies. Ofori-Atta is leading reforms to open up Ghana’s financial system and make it more transparent.

“Good corporate governance is key to transforming corporate organisations in frontier and transition economies, and policies that seek to plug gaps in weak corporate governance structures are essential to creating robust economies”, said Ofori-Atta at this year’s Africa CEO Forum in Abidjan, Côte d’Ivoire. The Africa CEO Forum, described as Africa’s Davos, is organised by Groupe Jeune Afrique and counts the Bretton Woods’ International Finance Cooperation (IFC) as one of its major sponsors.

U.S., Nigeria, Ghana

The 2008 financial crisis that hit the United States and shook the whole global economy to its core was a poster child of lax corporate governance. As the U.S. was languishing in the backdrop of what is arguably among that country’s major crises in recent decades, one of Africa’s largest economy, Nigeria, suffered a banking sector crisis in 2009. Much like the U.S., Nigeria’s crisis resulted from a corporate governance gap that engendered its own set of financial woes.

Poor governance structures are mostly responsible for the inability of frontier markets - both at the sovereign and corporate level - to develop strong capital markets. Regardless, even large economies cannot protect themselves from the insidious rot of poor corporate governance.

Strengthening financial market and banking regulations remains a significant challenge, and Ghana’s financial sector is no stranger to gaps in its corporate governance structures. A 2015 Asset Quality Review, conducted by Bank of Ghana, exposed nine banks that were on their last legs and barely solvable. In the last year alone, three banks have faced the full rigours of the law.

Locking-in recent macroeconomic gains is essential to ensuring irreversibility, and for that matter, the enforcement such major milestone enactments like the Public Financial Management Act and the establishment of a financial stability board provide the requisite governance structures to contain risk in the financial system. Both enactments are being pushed by Ofori-Atta and his team.

The rule of law matters

Ofori-Atta is not daunted by the challenge, what with his uncompromising stance to strengthen the country’s banking sector and make Ghana a financial hub as proposed by the government’s transformational agenda (Ghana Beyond Aid). For him, the rule of law matters in corporate governance.

And in an effort to “mop up the mess inherited from the last administration”, the minister sees minimum capital increases for banks, insurance and the securities market, as important to strengthening impaired banks. The plan is to enable credit to the private sector; a key player in government’s commitment to growth and jobs.

Bank of Ghana’s recently released corporate governance directives serve as a vital authoritative rulebook for limiting unfettered powers that may lead to imprudent banking decisions and, by extension, negative ramifications.

The directives, which target all regulated financial institutions, are both stern and cautious. They authoritatively demand all concerned institutions to ensure that the positions of Board Chairs and Chief Executive Officers (CEOs) are separate.

Regulated financial institutions are also expected to have independently led audit committees, on the one hand, and risk committees, on the other.

It is likely the move may restore stakeholder confidence in the banking system and encourage institutional investment in the sector, as most banks seek to meet new capital requirements by December 2018.?

Transferable lessons

Looking at transferable lessons from across Africa and beyond, a move by Nigeria’s stock exchange to soon rank all listed companies on corporate governance may well provide the supervision needed to ensure efficiency.

Ghana is also embarking on a raft of reforms to set up a rating agency to rate banks and insurance companies. “Such rankings could serve as an incentive for good corporate governance”, said Ofori-Atta. This promises to strengthen shareholder rights and buttress the role of institutional investors in the country.

Analysts argue that such a move to incentivise corporates to practice good governance could lead to the creativity and efficiency known to have characterised East-Asia’s corporate governance development.

Corporate citizenship

Corporate governance does not stop with traditional financial dynamics. The social and environmental performance of corporates and stakeholders along value chains are also taken into account; the Sustainable Development Goals (SGDs) are clear about private sector engagement.

In recent times, corporate social responsibility (CSR) and sustainability have been added to the corporate governance portfolio, setting the direction for responsible corporate citizenship.

Giving back to society is a mainstay of corporate citizenship. “We need to encourage a triangular understanding between corporates, social actors (including labour), and government within the sustainability framework,” said Ofori-Atta.

Before the government began rolling out the ‘Free Senior High School Initiative’ (Free SHS), it was not unfounded when pundits debated the rules of engagement for corporates.

An element of their corporate social responsibility involved providing support for outstanding but needy students. A bid to prevent the Free SHS initiative from eliminating contributions corporates made towards education was the driving force behind the ‘Voluntary Education Fund’ in the 2018 Budget.

The Voluntary Education Fund speaks to the need to engage corporates in building human capital, and could creatively harness the fund to invest in other strategic areas in education like Science, Technology, Engineering and Mathematics (STEM), and Technical and Vocational Education Training (TVET).

Opinions of Thursday, 5 April 2018

Columnist: Prince Moses and Sampson Akligoh

The rot must go: Good corporate governance to transform Ghana

Entertainment