The Akufo-Addo government on March 2 presented its 2017 Budget and Economic Policy statement dubbed the Asempa Budget to the nation through Parliament. The Budget read by Finance Minister Ken Ofori Atta a celebrated former investment banker, generated immense interest, praise and criticism across political, business and civil society platforms.

Indeed prior to the reading of the budget, various platforms were saturated with debates on:

1. Whether or not the promises of the new government as contained in their manifesto could be actually captured into governing economic policy. This was because some viewed the promises as mere political talk for winning votes and not ‘implementable promises’.

2. When it became clear that the government was not joking around with the said bold ideas but was bent on implementing them, the debate shifted to whether or not the promises should be stood down (at least in the first year) and the government should instead focus on fixing the fundamentals of the economy it inherited before launching into its fiscal expansion program.

3. Upon hearing the actual budget and outline of economic policies, (and how the government had balanced the need to correct the inherited challenges with need to invest in the fulfilment of its promises), the debate has now shifted to whether or not the programs (born out of the promises) as listed can be implemented to achieve the intended effect.

I have debated many of my colleagues on the other side in several post-budget debates that have taken place since March 2. I must admit these debates have been interesting and thought-provoking, often opening us all up to some key issues that are novel with this 2017 budget and the challenges that the budget implementation must seek to resolve. I believe that at the end of the debates there are some key lessons that we all, both Majority and Minority, can learn from the 2017 Budget and most importantly find a common ground on what it will take to implement the Policies therein.

Lesson 1

We can solve the problems and fulfill some of our promises at the same time

It is now established that the promises made by President Akufo-Addo on the campaign trail were not mere perfunctory vote buying screams. He meant to include them in his economic Policy agenda for governance. The biggest of them all have started finding space in his budgets starting with 2017. It is also now not in doubt that the economy of Ghana was in a bad way as at 7th January 2017 when President Akufo-Addo swore the oath of office.

But contrary to the suggestion that struggling countries need first to solve their problems (achieve Macroeconomic stability) and then later pursue a fiscal expansion program that leads to growth, the 2017 Budget evinces that an innovative approach can be adopted to achieve both objectives in one fiscal year.

Ghana’s 2017 budget has 4 pillars

- The economic status inherited by the new government

(Which I shall refer to as the Baseline Macro-Fiscal status)

- The NPP’s Manifesto Promises within the context of Ghana’s Medium Term Expenditure Framework (MTEF)

- 2017 Targets ( Macro-fiscal as well as qualitative)

- Economic Policies for the Fiscal year with which the targets can be met

From the onset, the budget Identified 5 major challenges to the Economy. Paragraph 5 of the budget captures the problems as follows

Mr. Speaker, let us acknowledge that we have inherited a challenged economy with:

• considerable debt overhang and rising interest payments caused by excessive borrowing;

• expenditure overruns and accumulated arrears caused by fiscal indiscipline, excessive sole sourcing and weak commitment controls;

• revenue underperformance caused by leakages, loopholes and tax exemptions;

• slowdown in economic growth caused by energy challenges and a lack of an enabling environment for the private sector; and

• limited capital investment, among others, due to rigidities from earmarking of revenues that severely limit the fiscal space and undermines the prioritization of government policies.

Debt

A considerable debt overhang meant our debt sustainability was being increasingly threatened (debt to GDP ratio above 70% contrary to global best practices).

It also meant our debt servicing costs were growing annually (estimated at 13 Billion on 22% of expenditure in 2017) and was further crowding out fiscal space (residual funds on the expenditure tables which could be utilized for discretionary government expenditure on growth initiatives).

No matter what it chose to do, the new government in addition to finding money to spend on its own promises, needed to find even more money to possibly pay down (amortize) even larger chunks of our debt to reduce the debt overhang or re-profile our existent debt to make its servicing more bearable.

Expenditure

Expenditure overruns and accumulated areas caused by fiscal indiscipline meant we were worsening the first problem on an annual basis. It also meant that we were increasingly limiting our ability to use fiscal policy in subsequent years to achieve our development objectives. Government needed to find a quick and firm way of ensuring more discipline in managing expenditure.

Revenue

Revenue underperformance was more as a result of poor tax performance than any other factor. This was due to a combination of preventable tax exemptions and disincentives created by the introduction of new taxes which the NPP considers to have been of nuisance value and inimical to productivity. Government quickly needed to remove some of these taxes while ensuring higher compliance by potential tax payers who will benefit from the expected resultant regime of increased productivity.

Restoring Accelerated Growth

The slowdown in growth in previous years has been mainly due to a lack of efficient investment in the real sector of the economy where growth is birthed. Agric & Industry have in recent years suffered from limited effective investment while oil admittedly also suffered significant issues in 2016.

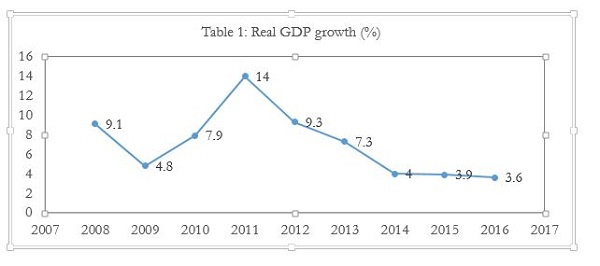

After years of decelerated growth (see table 1), it has become necessary that the new government restores Ghana to a period of accelerated if not appreciable stable growth. Accelerated growth is ideal because it is what will generate buoyant economic expansion and bring with it the jobs and incomes that Ghanaians desire.

Government in this budget therefore needed to find a way to (in the midst of the limited resources) still raise money to invest more significantly in Agric and also to boost industry. These will admittedly grow output (GDP) and bring along with it sustainable jobs and incomes. The governing Party’s manifesto had clear initiatives that can achieve these. The challenge was to find funding (space on the expenditure tables) for these. If we could fund some of these initiatives to boost Agric and Industry, non-oil based growth could be estimated to shore up once again and bring with it jobs.

Approach

The severities of the difficulties as inherited by the new government were the reasons for which many thought it would be impossible for the party to accommodate all the aforementioned ideals in the 2017 budget. The general economic theory prescribes that a government inheriting challenges like ours, has to pursue fiscal consolidation and clean up its books instead of attempting to invest for growth.

No wonder some economists and political watchers were dead sure there was no way the new government could find money to invest in the many bold promises it had made to the Ghanaian people ahead of the 2016 election.

For a nation with our challenges the standard Bretton Woods prescription would have been to go for fiscal consolidation, go for austerity, introduce new revenue enhancing measures (taxes), cut social spending, pay off debts, improve on our reserves and buffers and stay away from any interests in fiscal expansion.

Cognisant of these Macro-Fiscal Limitations, the Economic Management Team of the new government was confronted with the reality; the need to walk a tight rope between fulfilling as much of the Promises as we could and also curing as much of the ills we inherited as quickly as possible. The new government decided not to choose between the two objectives. It opted to do both.

1. Fulfill as much of our manifesto commitments as can be fulfilled in year 1 within the limitations of the economy we inherited.

2. Clean up as quickly (but not as shockingly as possible) the challenges inherited on the 7th of January. (The IMF tried shock therapy with us by imposing so many conditionalities aimed at helping us clean up. The evidence is that the shock therapy didn’t work). Our approach is to adopt a more measured and a more realistic approach.

The new government opted to tackle the two main budget instruments as follows:

(a) On the revenue side, government opted to shift the focus of the economy from taxing a few people highly, to taxing more people at a lower rate. The expectation is that by bringing reliefs and improving on productivity & compliance (which broadens the base) on the other hand, government will rake in enough revenues to meet our needs.

(b) On the expenditure side government opted to use an innovative twin approach of capping some expenditure items and expand investment in growth enhancing expenditure items. It also seeks to bring bout greater discipline in expenditure management and by so doing reduce the budget deficit to 6.3% of GDP this fiscal year even after funding the growth enhancing items.

The Budget is exciting because it does the following:

1. Makes more money available to pay off part of our old debts and arears even compared to previous year’s budgets.

2. Plans to Better rationalize revenue leakages and losses

3. Brings relief to the business community by reducing and abolishing as many nuisance taxes as can be done immediately while working to improve cash liquidity and lending rates in the broader economy.

4. Invests heavily in providing funds for development projects on a decentralized level

5. Invests heavily in entrepreneurial and growth initiatives

It is the combination of these measures that allow the projection of a 6.3% growth by year end; growth which is expected to create jobs and incomes for many more people this year. For all intents and purposes the balance with which this budget has been crafted provides a game changer that can rewrite the economic theory of balance between consolidation and growth.

Even if theoretical at this stage, I must admit the sheer ingenuity with which the 2017 budget has been structured is a beautiful piece of financial and economic engineering. It is indeed an ‘asempa’ (goodnews) which if successfully implemented will add to the rewriting of economic theory globally that it is possible to tackle Macro-fiscal challenges and restore accelerated, investment in social spending as well as jobs and incomes ALL IN ONE BUDGET CYCLE.

The EMT and the Technocrats at the Finance Ministry have been super smart in the piece of Policy that has been developed for the 2017 Fiscal year. What remains now is how to implement the budget successfully.

Lesson 2: Without Successful implementation, the ASEMPA will be useless.

Budget preparation is one thing. Successful implementation is another.

For all the exciting things I have already outlined about the 2017 budget, the truth is that it is only government’s economic policy on paper. It is its implementation that will determine whether or not the projected out-turns or results will be achieved.

Budget Implementation is in my opinion the second most important Part of the Budget. A budget is only as good as how effectively it is implemented. In previous years, many budgets have failed to achieve their projected out-turns because of difficulties associated with implementation.

The challenge is that while central government by the work of the Finance Ministry and the EMT can develop a game changing budget like this Asempa Budget, implementing the budget to achieve its objectives lies mostly in the hands of persons other than the Finance Minister and the EMT.

Meeting the revenue targets fall within the ambit of the GRA (an agency under the Finance Ministry admittedly). The Authority though it reports to the ministry is made up of thousands of agents in different divisions spread all over the country. Are all of these officers wholly committed to the revenue generation efforts that the corporate entity has been tasked with?

Will the loopholes already existent in tax collection widen or be necessarily tightened merely because these new measures have been announced?

Will the expected tax exemption cut-backs be implemented to effect by the field officers who actually do the work? Will the operators of our oil and gas infrastructure, whose job it is to meet the oil production volumes to enable government meet the revenue targets from oil actually hit their targets? These become the realities of meeting the revenue targets in any and even this 2017 budget.

On the Expenditure side, it has always been difficult to keep Ghana’s expenditure actuals aligned with projections. The challenge usually starts from government ministries themselves who undermine the estimate ceilings approved in the appropriations act by overspending their budgets. Already, most of us in the executive arm of government wish we had higher budgets to fund our programs and capex. Will we stay within the expenditure approved? Will we overspend, thus causing a deficit higher than projected? Will the finance ministry have the Political will to hold the line when colleague ministries start banging on the doors for more room to spend?

Another important function is the efficient execution of growth driving investment programs. After capping of earmarked funds, government has saved about 3 Billion Cedis which is being invested in growth initiatives including Infrastructure for Poverty Eradication Program. It is through IPEP’s 1 Million USD allocation per constituency that initiatives such as One District One Factory, 1 Village 1 Dam, small business support at constituency levels etc will be funded.

Will the New agencies be quickly set up to give effect to the vision? Will officers responsible for project appraisals, procurements and inspection deliver with a new sense of efficiency or will they be caught in the time old public service work style? Will the officers responsible for Planting for Food and Jobs work with dispatch and success to deliver the projected results? Will the persons responsible for using the GHS 200 Million stimulus package dedicated to revamping industry deliver their expected results?

It is the success of these various actors, the synergy of their various success that will deliver all the impressive results that the asempa budget projects.

How can the ASEMPA Budget Bear Fruits

1. Meeting the revenue target

In the 2016 Fiscal Year, government missed revenue targets by 11%. On top of the missed targets, the 2017 Budget projects a further revenue growth of some 33%. Again in the 2017 Budget while projecting a 33% growth, government is also assuming a 1 Billion GHS cut in taxes from the removal of various nuisance taxes.

Government is very much aware that there is the need to be firm on revenue collection in order to meets its targets in the midst of the above mentioned challenges. To this end, government is embarking on a mix of the following measures to ensure that revenue projections will be met by year end.

Bearing fruits in the revenue area requires government to do the following and work has already commenced on them.

i. A Tax exemption efficiency program to ensure that the about GHS 2.4 Billion given away in tax exemptions can be better managed to reduce the revenue losses that occur under the guise of tax exemptions. Of course this will face some push back from people who previously benefited from this loophole. But the commitment of government is firm and should hopefully lead to some good net savings when compared to the tax cuts.

ii. The GRA Post clearance audit regime is being encouraged to be more efficient now than ever. This will further reduce the losses due to under-declarations.

iii. Efforts at broadening the tax base have already commenced. First with the expected new taxable persons (individuals & corporates) who will be brought into the tax basket following the expected economic expansion and its attendant growth in employment and incomes. Secondly the GRA is expected to recruit more tax payers following the reduction in rates (VAT Flat rate and reduced rates on various tax handles) and the attendant expected voluntary compliance that comes with it. Already, if Press reports suggest that various trader groups have announced commitment to voluntarily register their members to pay following the reduction in rates.

iv. Tax compliance is expected to go up as the GRA again rolls out enhanced tax compliance programs to ensure that potential tax payers are actually paying the right rates. For example a recent res

v. earch undertaken by the Integrated Social Development Centre (ISODEC) reveals that about 80% of tax revenue has been lost at Kotoka International Airport through under invoicing and over invoicing of imported goods. To control such illegalities, defaulters or persons who underpay are being engaged to pay their fair share. Additionally prudent monitoring measures are being put in place to curb the existing loopholes in tax collection and to ensure that the right amount is been paid by various taxpayers. This way, the illegal non-payment or underpayment of tax will be prevented.

vi. Non-Tax revenue sources are also being managed with a firm hand. Government is not leaving things entirely in the hands of non-tax revenue payers to determine whether or not they will meet their revenue targets and in so doing pay government its share. For example the low productions in the oil industry last year are being addressed to ensure that for example the turret bearing challenges on the FPSO Kwame Nkrumah does not lead to huge gaps in oil revenue. Other oil revenue sources are also enjoying a closer management regime from the relevant ministries to ensure their revenue projections are better met this year. The expected effect is that non tax revenue sources should not fail by similar margins this year and that revenue targets have a higher likelihood of being met. digress

2. Expenditure discipline

Ghana has over the last decade recorded average budget deficits of about 8%. Often the worst expenditure over-runs have occurred in election years. The consequence is that Ghana’s debt keeps ballooning as we add annually to the debt stock following the yearly deficits. This year, Ghana intends to make a break from this pattern by slowing down the rate of debt accumulation and in effect reducing the debt to GDP ratio.

Yearly deficits are usually occasioned on account of unplanned spending, poor budgeting in cases where the spending is even planned, poor monitoring of actual spend.

To correct this, government is doing the following among other things:

i. Firmly applying the PFMA act to ensure that first of all, the budgeting process is stronger now more than ever. This is the first step in ensuring realistic expenditure projections.

ii. Expenditure management in strict compliance with PFMA particularly focusing on section 96 which seeks to punish government officials for over-expenditure. Government is by this sending a strong signal to its ministers and allies that it doesn’t intend to spend without recourse to budget approvals. We ourselves intend to be a check on ourselves and not to undermine the fiscal recovery efforts we are undertaking.

iii. Government is working to further strengthen the Fiscal accountability framework with the introduction of a fiscal oversight body, as well as being openly accountable for even its own debt and budget balance targets. This should ensure that expenditure is effectively controlled this year.

iv. Public Procurement is being strengthened with specific GHIFMIS codes for each contract as well as “value for money” audits for projects. This ensures efficiency in every cedi spent.

v. The establishment of a Risk and Treasury Department proposed by the financed Minister is very essential as it will play a central role in the finances of the country. It will be responsible for the country’s liquidity by ensuring that there is enough funding available at all times to meet primary needs of the citizenry. The department will reduce unwarranted borrowings in the short term, re-profile our debts and by so doing reduce the interests costs on the expenditure side of the fiscal tables.

3. Efficiency in implementation of Growth driving investments

The 2017 Budget projects growth of 6.3%. It is inherent in this growth that we expects jobs and income. In order to achieve this growth target, government has initiated a number of programs the success of which will deliver the said growth. These include: IPEP (comprising 1 million USD Per constituency, one District one Factory, one Village one Dam, planting for food and jobs, small business support at constituency levels etc).

To ensure the successful implementation of these government is encouraging all actors in the delivery chain to work with a clear sense of efficiency and speed. Everybody in the delivery chain is being encouraged to focus on achieving results.

Actors are also being encouraged to avoid waste, inefficiency and corrupt practices in all their operations. These are major inhibitors to efficient delivery. All actors ought to pride themselves in nothing except the successful execution of their tasks.

Conclusion

The ASEMPA budget is a master-stroke in reorganizing Ghana’s finances. It starts us on a recovery path to cure our ills and also sows the seeds for accelerated growth and jobs. But its implementation will be more important now than its crafting. Its successful implementation is what will lead to the results envisaged.

Though its implementation is not solely within the ambit of government, all stakeholders responsible for the implementation should be fully brought on board in pursuance of this economic renaissance agenda.

It is heartwarming that government on its part has done all the right maneuvers required. Even in signaling effective implementation, government has shown the right lead. The time has now come for all stakeholders to do their part so that the results will accrue to the Good people of Ghana.

Let’s get to work!!!

Opinions of Monday, 8 May 2017

Columnist: Kojo Oppong-Nkrumah