OmniBSIC Bank Ghana continues to demonstrate its commitment to sustainable, Environmental, Social, and Governance (ESG) practices by partnering with the Ghana Airports Company Limited (GACL) and the Environmental Protection Agency (EPA).

At a ceremony to mark the 'Joint Safety and Environment Week', organized by the Ghana Airports Company Limited at the Kotoka International Airport (KIA) under the theme: ‘Uniting Aviation for a Safer and Greener Tomorrow’, the Bank donated state-of-the-art waste segregation bins to support effective waste management at the airport. The Bank also, in partnership with the Environmental Protection Agency (EPA) has launched an initiative to reduce the use of single-use plastic products.

The donation to the GACL and the partnership launch with the EPA are in line with the Bank’s broader strategy of promoting responsible waste segregation, including reducing, reusing, and recycling, particularly in sectors like aviation where sustainable practices are critical for long-term survival.

Speaking at the event at the Kotoka International Airport (KIA), Mrs.Chidinma Braye-Yankee, Group Head, Corporate Affairs of OmniBSIC Bank Ghana, who read a speech on behalf of the Bank’s Managing Director, Daniel Asiedu, highlighted the importance of ESG initiatives in creating shared value.

“These bins represent our dedication to promoting sustainable waste management practices, which are essential in driving the agenda for a greener future. For OmniBSIC Bank, this project reflects our deep-rooted commitment to ESG objectives and demonstrates how partnerships can drive the shared value of supporting environmental sustainability while enhancing safety and operational excellence in key sectors,” she said.

She expressed confidence in the impact of the donation, noting, “We are certain that these bins will advance GACL’s ongoing effort in creating a safer and greener environment for travelers, staff, and stakeholders. I commend GACL for its leadership in this initiative, setting a remarkable example for other sectors to follow. We look forward to seeing these efforts ripple through the industry and inspire greater collaboration for sustainability.”

Mr. Dominic Donkoh, Chief Risk Officer, speaking at the EPA event in Accra, noted that as a financial institution, OmniBSIC Bank is committed to promoting a greener and cleaner world. “The environmental and socioeconomic consequences of plastic waste are far-reaching, impacting our ecosystems, public health, and economic prosperity. This sensitization programme is particularly commendable because it tackles the issue at its source—the point of entry. By creating awareness and implementing control measures, we are not only reducing the influx of these harmful materials but also encouraging responsible consumption and waste management practices.

"At OmniBSIC Bank, our commitment to environmental stewardship is reflected in our operations and corporate social responsibility initiatives. We actively support programmes that promote environmental protection, resource efficiency, and community empowerment. Today, we reiterate this commitment by standing with the EPA and all stakeholders in this fight against plastic pollution,” he said.

Mrs. Yvonne Nana Afriyie Opare, Managing Director of GACL, emphasized the organization’s commitment to strengthening partnerships across the aviation industry to advance safety and environmental sustainability.

“This year’s theme reflects our dedication to uniting aviation stakeholders in addressing safety and environmental concerns. Together, we can create a safer and greener future for the industry and its stakeholders,” she stated.

The growing importance of ESG in finance and banking

Data from the Global ESG Banking Study 2023 indicates that 76 percent of financial institutions now align their strategies with ESG goals, recognizing that sustainability efforts directly impact long-term profitability and societal impact. Similarly, the aviation industry, responsible for approximately 2.5 percent of global carbon emissions, has embraced sustainability practices as critical to its operations. Initiatives like waste management, energy efficiency, and eco-friendly operations are vital in reducing the sector's carbon footprint.

OmniBSIC Bank’s partnership with GACL and the EPA highlights the growing trend of cross-sector collaborations to meet ESG goals. By aligning with key stakeholders, the bank is setting a benchmark for integrating environmental responsibility into its operational framework while supporting the aviation sector's sustainability initiatives.

The two events brought together officials from Africa World Airlines (AWA), Passion Air, OmniBSIC Bank, the Environmental Protection Agency (EPA), the Ghana Civil Aviation Authority (GCAA), and other stakeholders reflecting a collective commitment to building a future where safety and environmental sustainability are central to industry operations.

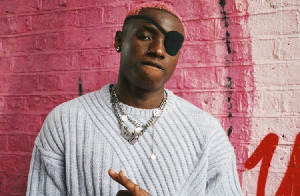

Chidinma Braye-Yankee, Group Head, Corporate Affairs of OmniBSIC Bank Ghana speaking at the event at GACL

About OmniBSIC Bank

OmniBSIC Bank is a fully-fledged universal bank that traces its roots to a merger between the erstwhile OmniBank and Sahel Sahara Bank. The merger was spurred by the banking sector consolidation program introduced by the Bank of Ghana (BOG) in 2017 through several directives, including the increment of the minimum capital requirement almost fourfold from GHS 120 million to GHS 400 million. Merging the two banks is one of the most successful in the financial services industry because the two banks had similarities in business modules, and size also the stakeholders (staff management and directors) were willing to embrace the merger due to the potential synergy it could create to make the “new” bank a significant player in the banking and financial services sector.

OmniBSIC has reinforced its corporate governance structures and invested in its infrastructure to align with Bank of Ghana’s (BOG’s) Corporate Governance and other regulatory standards. The Bank is dedicated to maintaining the highest level of integrity, transparency, and accountability in all operations, thereby creating a reliable framework for customers to carry out their banking activities with convenience and confidence.

Headquartered in Accra’s Airport City, OmniBSIC Bank serves its customers through a network of 40 branches across Ghana. The Bank also offers a comprehensive suite of products, services, and digital solutions tailored to corporate, SME, and individual needs while actively supporting the communities within which it operates. To deliver exceptional banking experiences daily, OmniBSIC prioritizes investment in technology and employee development. This commitment is reflected in its rigorous staff selection process and comprehensive capacity-building programs.

OmniBSIC Bank has undergone a comprehensive transformation, showing improvements across all areas—including financial performance—while achieving numerous successes and receiving multiple recognitions including, The Most Customer-Centric Bank (CIMG, 2022), The Fastest-Growing Corporate Bank in Ghana (Global Banking and Finance Awards, 2023), The Best Bank in Ghana (Ghana Business Awards, 2023), Bank of the Year (Ghana Business Standard Awards, 2024), SME Bank of the Year (Ghana Credit Excellence Awards, 2024), Best Ghanaian Owned Emerging Band (Made-In –Ghana Awards, 2024) and Best Corporate Bank, Ghana (Global Banking and Finance Awards, 2024) and currently ranked 29th best company by GIPC’s Ghana Club 100.

The Bank is a member of the Ghana Deposit Protection Scheme. For more information, please visit: www.omnibsic.com.gh

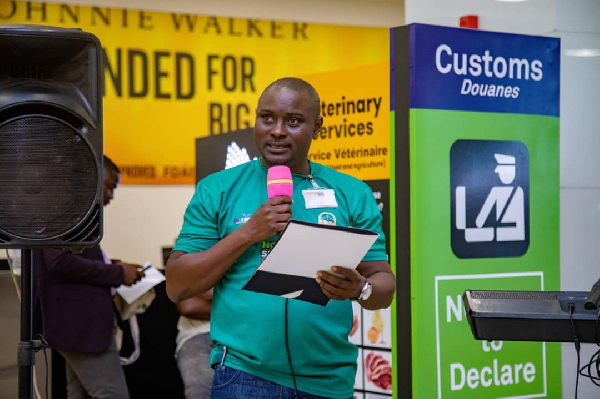

Dominic Donkoh, Chief Risk Officer at OmniBSIC Bank speaking at rhe EPA event

Click to view details

Press Releases of Wednesday, 25 December 2024

Source: OmniBSIC Bank