DailyNewsGhana Blog of Monday, 23 December 2024

Source: Michael Agyapong

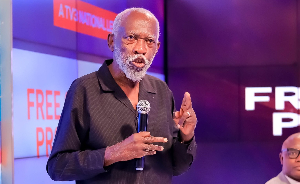

Increase betting tax from 10% to 50% – Adei tells Mahama

Professor Stephen Adei, a renowned economist and former Rector of the Ghana Institute of Management and Public Administration (GIMPA), has called for an increase in Ghana's betting tax from 10% to 50%. He believes betting is a detrimental habit that should be strongly discouraged through higher taxes.

Speaking on TV3's "Hot Issues" program on Sunday, December 22, 2024, Prof. Adei described taxes on harmful behaviors as “sin taxes” and argued for their increment, citing examples from global practices. “As a father, as a Christian leader, we call it sin tax. Sin taxes must be higher, not reduced. Everywhere in the world, cigarette taxes, alcoholic taxes, and betting taxes are higher. I would want them to be 50% because I don’t want my grandchildren to be betting. Betting is one of the disastrous habits that we should discourage,” he remarked.

His comments come in response to President-elect John Dramani Mahama's promise to scrap several taxes within his first 100 days in office. Among these taxes are the e-levy, COVID levy, betting tax, emissions levy, and import duties on industrial and agricultural equipment. Prof. Adei, however, urged caution, emphasizing the importance of keeping taxes that are easier to collect and economically impactful, such as the e-levy.

He elaborated on the need for a comprehensive tax review, criticizing the excessive number of taxes, particularly on imports. "I imported something and saw about 21 taxes on our car import. That is ridiculous. We need a total look at the taxes, but in doing so, focus on ones that are easier to collect and have a broader base," he explained.

Prof. Adei noted that only about one million Ghanaians pay income tax out of an adult population of approximately 16 million, stressing the importance of expanding the tax base through measures like property taxes, which are easier to enforce. He also highlighted the need for local governments, particularly in cities like Accra, to efficiently collect property rates.

While acknowledging that President Mahama may need to fulfill his campaign promise of removing the e-levy, Prof. Adei advised careful reconfiguration of the tax system to reduce inefficiencies and ensure fiscal sustainability. He warned against overpromising, citing President Akufo-Addo’s inability to manage public expectations as a cautionary tale.

“Expectation management is crucial in governance. President Akufo-Addo’s failure to deliver on promises like ‘Ghana beyond aid’ was a significant downfall. President-elect Mahama must take this lesson seriously and manage the expectations of Ghanaians wisely,” Prof. Adei concluded.

![Former President Akufo-Addo [L] and Okatakyie Afrifa Mensah Former President Akufo-Addo [L] and Okatakyie Afrifa Mensah](https://cdn.ghanaweb.com/imagelib/pics/587/58758132.295.jpg)