Spencer Wan Blog of Wednesday, 18 December 2024

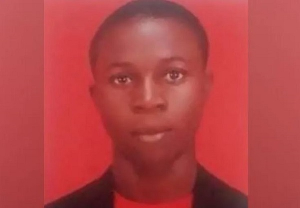

Source: Eric Afatsao

A five-year sentence was imposed on the hairdresser for taking GH¢81,060 out of the GCB customer's account.

In a fraudulent plan that resulted in the removal of GH¢81,060 from a customer's Ghana Commercial Bank (GCB) account, Jessica Oforiwaa, 34, a caterer and hairdresser, was sentenced to five years in prison by an Accra Circuit Court.

The court's facts indicate that Jessica Oforiwaa used a cloned checkbook to plan the transaction. She created fake checks by chemically altering them with the help of her accomplices. It took some time for the bank to discover the fraudulent conduct, but in 2023 it did so after finding anomalies in its financial records.

The prosecution disclosed that GCB Bank officials found eight counterfeit checks that had been cashed, causing large losses. The suspicious checks were sent to Camelot Company Limited, the approved manufacturer of GCB checkbooks, for forensic analysis after the discovery was made by the complainant, Daniel Boakye, a Security Coordinator at the GCB Bank High Street branch in Accra.

The connection between the copied checks and a checkbook issued to Oforiwaa's business account, Jesnat Cook Company, was verified by Camelot Company Limited. According to investigators, Oforiwaa and her associates chemically destroyed the original account information and signatures on authentic checks, substituting them with fictitious data that resembled the credentials of other clients.

When Oforiwaa and her friends submitted the forged checks to unwary bank officials, they were able to take large amounts of money out of a number of accounts. The fraudulent activity was discovered through normal inspections, yet the plan remained undiscovered.

Forgery, conspiracy to conduct crime, and defrauding by false pretenses were the charges brought against Jessica Oforiwaa after her arrest. Throughout the trial, she was convicted on every count. According to the court, which was presided over by Judge Patricia Amponsah, her acts were planned and detrimental to Ghana's financial institutions' reputation for reliability.

A clear reminder of the legal ramifications of financial crimes and the extent the judiciary is willing to go to protect the banking industry is provided by Oforiwaa's conviction. The pursuit of her co-conspirators is still going on.

The case highlights the vulnerabilities of banking systems to sophisticated fraud. GCB Bank has since implemented enhanced measures to detect and prevent similar schemes. Customers are also being educated on the importance of regularly monitoring their accounts and promptly reporting irregularities.

This conviction sends a strong message to fraudsters while reassuring the public of the financial sector's commitment to maintaining integrity and accountability.

https://web.facebook.com/share/p/19uAwdTfhK/.