Ted News Ghana Blog of Friday, 28 February 2025

Source: TEDDY VAVA GAWUGA

Ghana in Talks with World Bank for $250M to Support Banks Affected by DDEP

The Government of Ghana is in advanced negotiations with the World Bank to secure a $250 million funding facility aimed at supporting banks and financial institutions impacted by the Domestic Debt Exchange Programme (DDEP).

Objective of the Funding

This initiative is part of the broader Ghana Financial Stability Project.

The funds will provide crucial capital to struggling financial institutions post-debt restructuring.

The government aims to recapitalize at least 11 financial institutions in 2025.

Government’s Commitment to Financial Stability

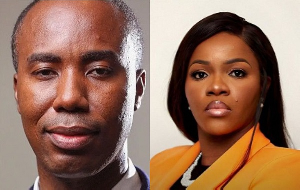

Speaking at the launch of the Ghana Association of Savings and Loans Companies’ five-year strategic plan, Andrew Amerkson, Head of Banking and Non-Banking at the Ministry of Finance, emphasized the government’s focus on sector stability.

On behalf of Finance Minister Dr. Cassiel Ato Forson, he noted the government’s proactive approach, citing the Ghana Financial Stability Fund, which allocated GH¢5.7 billion to recapitalize bonds and stabilize the financial sector.

Impact of Past Interventions

Dr. Forson highlighted the success of the Ghana Financial Stability Fund A2, which supported 11 financial institutions last year, including:

4 banks

4 capital market operators

3 insurance companies

World Bank Loan: A Key Step Forward

The $250 million loan will focus on recapitalizing banks and savings and loans institutions (SDIs).

It aims to enhance financial sector stability and restore confidence in Ghana’s banking system.

Dr. Forson stressed that beyond addressing liquidity challenges, this funding will ensure that financial institutions remain resilient and contribute effectively to economic growth.

The DDEP’s Impact on Banks

The impairment losses from the DDEP have rendered some local banks technically insolvent, requiring:

Additional capital support from shareholders

Full participation in the Ghana Financial Stability Fund

An IMF Country Report (23/168) indicated that the World Bank, other donors, and the Ghanaian government were expected to provide GH¢1.5 billion to help build capital buffers for qualifying banks.

Government's Next Steps

The government’s latest move comes at a critical time, as it works to:

Stabilize the banking sector

Restore investor and depositor confidence

Ensure the resilience of financial institutions amid economic challenges