A financial analyst, Dr. Amoh Baffour, has decried the inability of the Akufo-Addo administration to pay customers of the defunct microfinance and savings and loans companies.

The lecturer with the Business Administration Department of the Pentecost University, Dr. Amoh Baffour said he was surprised the ruling New Patriotic Party (NPP) administration had failed to pay depositors of the banks that the government collapse during its banking sector clean-up.

In the past two years, the Bank of Ghana’s reforms has led to the collapsed of nine local banks, 347 microfinance institutions and some 23 finance houses.

On 1 August 2018, the Bank of Ghana announced the consolidation of the failed local banks, which included the Royal Bank, Beige Bank, Construction Bank, Sovereign Bank, and Unibank. Later on, HBL and Premium Bank were added to the first five.

The collapse of the nine local banks birthed the state-owned Consolidated Bank Ghana (CBG) Limited.

]This was after the Central Bank on 14 August 2017 approved the takeover of UT Bank and Capital Bank, by the state-owned GCB Bank Limited.

More than 152,000 depositors have been affected since the these Micro Finance Institutions, Savings and Loans Companies and banks were folded up for what the government described as their inability to meet liquidity standards.

Some frustrated customers, some of which have been ejected from their homes for their inability to pay their rent, as businesses of others have suddenly collapsed resulting in sleepless nights and hunger among thousands.

Promises

Following demonstrations upon demonstrations for their monies; curses, assurances have been given by the government to refund the deposits amidst modalities, but till date tens of thousands have virtually been disappointed even after President Akufo Addo’s assurances in December last year which was firmed up during the Stateo of the nation address that all monies will be paid.

Last year, President Akufo-Addo announced some 15.6bn had been allocated to cater for the frustrated customers’ needs as pressure and threats heightened.

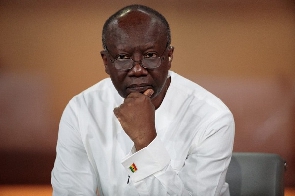

A letter addressed to the Minister of Finance, Mr Ken Ofori-Atta, by the President’s Executive Secretary Nana Asante Bediatuo, said, “The President has granted executive approval for an expenditure of up to fifteen billion six hundred million Ghana cedis (GHC15,600,00,00.00) toward protecting depositors and investors of failed financial institutions and to improve liquidity of the financial sector”.

At the 2020 State of the Nation Address, President Akufo-Addo again confirmed before Parliament the monies have been released and stated payment was to begin on February 24, 2020.

However, four (4) months after the pledge, the disgruntled customers are yet to receive their funds in full. Others have reported a paltry 5% of their total deposits which is fast dwindling confidence in the Akufo-Addo government that is battling to fulfill half of its manifesto promises prior to the 2016 general elections that brought the NPP to power.

Is The Economy Weak?

The economy comes crumbling under Akufo-Addo despite attempts by his government to paint a glossy picture to spite its predecessor whose economic achievements stand tall.

Dr Baffour believes the country’s economic indicators have not been favorable for the past few years, hinting that could be an underlying factors hurdling the payment processes the government announced.

“If the government finds it difficult to pay the depositors, it proves one thing: that the economy is not in good shape,” Dr Amoh told the media.

He also noted that while the government has failed to boost the economy as promised, paying the depositors will not come easy because inflation will expose it.

“Government cannot print monies to pay the depositors. The government does not have any free money elsewhere to settle the depositors.”

Government should have supported the microfinance companies falling banks with a bailout to sustain jobs and avert this pressure. I say this because business would have moved up steadily and sustain the economy,” he added.

General News of Wednesday, 17 June 2020

Source: dailymailgh.com