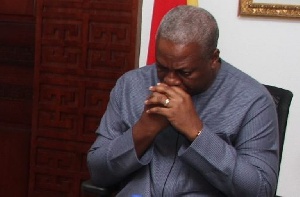

Snippets of information emanating from the National Health Insurance Authority (NHIA) indicate that the Authority’s investment in the private financial company, All Time-Capital Limited, was initiated by the John Dramani Mahama-led administration in 2012.

A letter dated July 26, 2012, a copy of which is in possession of kasapafmonline.com suggest that, just two days after Mahama took over the reins of the country following the death of then sitting President, John Evans Fiifi Atta Mills, he gave approval for the first release of GH¢5,000,000.00 to be placed on one year fixed deposit to the investment company.

The investment management and advisory firm had on July 19, 2012, presented an investment management proposal to establish an investment management relationship with the NHIA.

The company requested for an amount of GH¢5,000,000.00 at a rate of 24% per annum for a tenure of 365 days.

Then Chief Executive Officer (CEO) of NHIA, Sylvester Mensah, who bought into the proposal directed that some funds of the NHIA which was “idle at GCB” should quickly be moved and “place it properly to earn very attractive interest” in All Time-Capital Limited.

He therefore ordered the accountant to vet and process for the payment of GH¢5,000,000.00 as investment in All Time-Capital Limited.

This move is a clear contradiction to a statement made by the National Democratic Congress (NDC) at a press conference on Monday, April 15, 2019, during which they accused the Akufo-Addo-led New Patriotic Party (NPP) administration of transferring GH¢17,548,377.20 to All Time-Capital Limited as investment which has since been locked up.

In November 2015, an additional GH¢1 million 182-day fixed deposit investment was made with the same investment company, All-Time Capital.

This trend continued with the rollover of principal plus accrued interest to date.

The rollover of principal plus accrued interest increased the amount to GH¢6.2 million on July 26, 2013 at an interest rate of 24%.

Similarly, on July 26, 2014, NHIA rolled over the principal plus accrued interest, translating the investment to GH¢7.6 million (GH¢7,688,000) at an interest rate of 26.84%.

The Health Insurance provider again rolled over the principal plus accrued interest, making it GH¢7.9 million (GH¢7,939,722.60) at a rate of 26.84%, on March 11, 2015.

On March 20, 2015, NHIA’s deposit dropped to GH¢5.9 million (GH¢5,915,203.21) with an interest rate of 26.84%.

On April 1, 2015, it came down further to GH¢4.9 million (GH¢4,943,632.64) at an interest rate of 28.41%.

However, on September 30, 2015, the figure increased to GH¢5.6 million (GH¢5,643,952.62) at a rate of 27.97%.

The investment rose to GH¢7.2 million (GH¢7,222,566.17) on September 29, 2016 at an interest rate of 27.70%.

The National Communications Director of the NDC, Sammy Gyamfi, who made this observation while addressing issues related to the state of the National Health Insurance Scheme (NHIS) said managers of the NHIA were finding it very difficult to retrieve the locked up investment fund which was paid in three tranches.

General News of Tuesday, 16 April 2019

Source: kasapafmonline.com