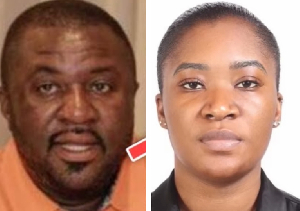

The Executive Chairman of DOSCAR Group of companies, Oscar Yao Doe, has charged President Nana Akufo-Addo to walk his talks by holding accountable, persons whose decisions are undermining the economy.

The businessman said he wants to see more on the part of the president that he is in charge of the country as the banking sector faces huge job losses and collapse.

His comments follow Mr. Akufo-Addo’s recent statement blaming past officials of the Central Bank and other regulators of the financial institutions for the crisis in the banking sector.

“If the BoG in the years before had acted responsibly and dealt with some of these issues like it should have done, we never would have gotten into the situation we are now.

“It was relaxed and as a result look at the amount of money that the public has spent,” the said, revealing that “at the first phase of the banking scandal, GH¢13 billion had to come from public funds to make sure that depositors funds were secured,” the president said.

“However, in a post, Mr. Doe said: “With all due respect to the President of Ghana, H.E Nana Akufo-Addo @nakufoaddo, even though I do not doubt his words, I want to see (real) action so I can be convinced he is truly in charge of the country!

“I believe the history of Ghana can be corrected and the souls of those treated unfairly can be healed!

“(President Akuffo-Addo) @nakufoaddo has an obligation to Ghana because he swore an oath of office in public to hold the TRUTH for Ghana, and defend its interests, even with his blood. Therefore, action is needed immediately to proof that he is in charge of Ghana, and not those empty-headed egoistic and vendetta-minded guys. (So, he should do the following..)

1. Initiate investigation to find out why Nii Amanor Dodoo, who led KPMG to audit the banks was himself appointed as the Receiver of the same banks he audited in his capacity as the head of KPMG Ghana.

2. Investigate same scenario within other banks where the head of the audit firms that did the audit were also appointed as Receivers (to) enabled them cover up their own rot.

3. Suspend the Governor of the Bank of Ghana, 1st Deputy Governor and 2nd Deputy Governor for committing a once-in-a-lifetime error to hurt the economy of Ghana.

4. Sack the Finance Minister, Hon. Ken Ofori Atta, and his deputies for failing to follow the US Model, or the European Commission precedent (in 2008 and 2009) which saved European Banks who were in worse situation than the banks in Ghana.

See the European precedent below:

State aid to businesses, including banks, is generally prohibited under EU law as it distorts competition. In order to ensure that state aid does not compromise the integrity of the EU’s single market, it is subject to control by the European Commission. Given the large sums involved in state aid to banks and its potential to distort competition, the Commission’s role in controlling it is of paramount importance. In some circumstances, however, such government intervention may be necessary in order to make the economy work properly.The 2008 financial (or banking) crisis was considered one such instance. It saw an unprecedented increase in state aid to banks in the form of “bail-outs”. These were deemed necessary.

See Below The US Precedent.

“The Emergency Economic Stabilization Act of 2008 created the $700 billion Troubled Asset Relief Program to purchase toxic assets from banks. The funds for purchase of distressed assets were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases.”

General News of Friday, 23 August 2019

Source: starrfm.com.gh