Banks with a capital adequacy ratio (CAR) of less than 10 percent of their assets have been asked to submit plans for recapitalisation, Bank of Ghana Governor Dr. Ernest Addison has disclosed.

The ratio – a principal financial soundness indicator – demonstrates banks ‘ ability to finance their long-term capital expenditures and ventures, and was reduced from 13 percent to 10 percent in December 2022 as part of a slew of measures aimed at mitigating the domestic debt exchange programme’s (DDEP) impact on banks, as they were over-exposed to the Treasury instruments… holding a third of all outstanding cedi-denominated bonds.

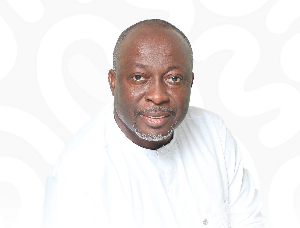

Responding to questions about banks’ solvency at the end of the 111th ordinary meeting of the central bank’s Monetary Policy Committee (MPC), Governor Addison stated that the regulator had met with operators of the banks whose capital has been impacted to submit plans for a fresh injection of funds.

“Those banks that are currently reporting CAR below 10 percent will be required to submit recapitalisation plans; in fact, we already met with them last week and asked those banks that have had their capital levels impacted to submit recapitalisation plans for the central bank to review,” Governor Addison stated.

The apex bank’s head added that the processes through which impacted banks can apply for support from the GH¢15billion financial stability fund are being finalised.

In addition to reduction in the CAR to 10 percent, losses from the DDEP are to be reflected in the computation of CAR over a period of up to three years.

Consequently, the industry’s average CAR stood at 15.7 percent in December 2022 compared to 16.6 percent at the end of 2021. The adjusted CAR was influenced by valuation losses on central government bonds, increased credit risk, and revaluation losses on loans denominated in foreign currency, the central bank noted.

For additional context, the industry’s CAR was at a healthier 19.8 percent in December 2020, significantly above the minimum regulatory requirement of 11.5 percent – which was reduced from 13 percent with the advent of COVID-19 as the BoG sought to stimulate private sector lending.

A banking consultant, Dr. Richmond Atuahene, citing a recent study he authored on the impact of the DDEP on the solvency of banks, said the call for recapitalisation did not come as a surprise as there were some banks already walking a tightrope even before the onset of the DDEP.

“I am not surprised this has happened, as we have already seen the moves some banks have made in the past month,” he said with reference to announcements by some foreign-owned banks, including South Africa-based Standard Bank and First Rand Bank, that they are looking to recapitalise their Ghanaian operations, with the former being reported to have set aside 1.5 billion South African Rand (ZAR) – approximately US$81million – to cover potential losses emanating from the DDEP.

He, however, expressed concern that some locally-owned banks might struggle to raise funds, seeing that

the minimum capital requirement for banks was raised from GH¢120million to GH¢400million less than five years ago.

“Some of the local banks might struggle getting their shareholders to commit in raising the required capital, and this could have ramifications for their domestic and international operations – including trade financing,” he said while refusing to rule out the possibility of acquisitions by more stable banks.

Business News of Wednesday, 29 March 2023

Source: thebftonline.com

Banks with less than 10% CAR asked to recapitalise

Entertainment