Eurobond holders are likely to take a nominal haircut between 30 to 40 percent in the yet-to-be commenced external debt restructuring programme, Bloomberg has reported.

The development comes after Ghana halted payments of its Eurobond debt back December 2022 due to a raft of economic challenges pushing it to seek an IMF bailout package.

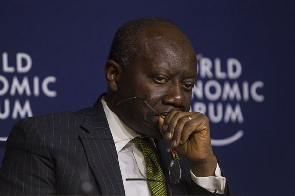

Minister of Finance, Ken Ofori-Atta speaking during an investor meeting in London on October 16, 2023 said two commercial creditor groups, one regional and one international, have since shared their restructuring proposals to government.

“In our indicative scenario, the restructuring terms for bondholders involve a nominal haircut between 30% and 40%, looking at coupons of no more than 5% and final maturities of no more than maybe 20 years,” Ken Ofori-Atta is quoted by Bloomberg.

“We expect to accelerate a constructive dialogue in the coming weeks,” he added.

Meanwhile, Ken Ofori-Atta speaking during a joint IMF, BoG and Finance Ministry press conference on October 6, 2023 said government aims to reach an agreement with external creditors by the end of this year.

Ghana is targeting to secure the second tranche of the $600 million package in November this year with plans to further engage bilateral creditors on an external debt restructuring programme.

The Ministry of Finance on its part has called on its bilateral creditors to swiftly come to an agreement to enable Ghana secure the second bailout package of the $3 billion Extended Credit Facility.

MA

Watch the latest edition of BizTech below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Watch the latest edition of BizHeadlines below

Business News of Tuesday, 17 October 2023

Source: www.ghanaweb.com

Eurobond holders could take between 30% to 40% haircuts – Report

Entertainment