The Ghana Revenue Authority served notice that businesses must not pirate tax stamps on fake products as this is a punishable offense.

According to the Authority it "is investigating a number of such cases, and we have even made some arrests. We want to make sure that such people are arrested and brought to book to allow genuine product manufacturers to operate in the country."

It was alleged that some businesses and individuals acquire tax stamps from the Authority genuinely and then affix them to another company’s products.

Read the full story originally published on November 8, 2018, by thebftonline

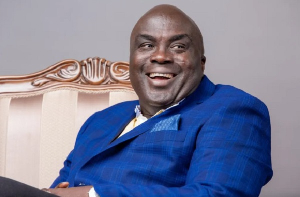

The Chief Revenue Officer at Ghana Revenue Authority (GRA), Kwabena Apau Anto, has said it is a crime for businesses to pirate tax stamps on fake products.

“The Authority is investigating a number of such cases, and we have even made some arrests. We want to make sure that such people are arrested and brought to book to allow genuine product manufacturers to operate in the country.

Some businesses and individuals acquire tax stamps from the Authority genuinely and then affix them to another company’s products. “That is what most people are doing. All that they do is pirate other people’s products,” said Mr. Anto, after GRA’s tax stamp taskforce visited some selected retail shops in Accra to inspect stamps on consumable products.

The exercise was aimed at ensuring that retailers comply with the law and sell consumable products with the approved tax stamps from the Authority. Some consumable products without the tax stamp were confiscated.

Some of the affected shops include the De-Latoya Enterprise in Osu, Voltic Retail Centre and N.J. Ventures – both in Achimota, and the Gbawe Depot of Accra Breweries Ltd., which had several beverages and bottled water.

Mr. Anto warned that shop owners selling products without tax stamps will be dealt with drastically.

He cautioned retailers, wholesalers, distributors not to take any product from any manufacturers without the stamps, because the law places a duty on them to sell only products with the tax stamps.

“We have given stamps to all suppliers,” adding that penalties of up to 300% of the products’ value will be imposed on defaulters – who may also face a sentence of five years.

He indicated that GRA will continue to visit the markets to ensure strict compliance with the law, and that importers are also expected to affix the stamps on their products.

“The Exercise is simultaneously ongoing in all 10 regions of the country, and we want to tell the retailers, distributors and wholesalers to compel manufacturers and importers to affix the stamps on their products,” Mr. Anto stated.

Mr. Anto explained that the manufacturing companies had received enough of the Tax Stamps from the Authority, and are supposed to distribute them to the various wholesalers and retailers to be affix on the old products.

“We even made announcements that anybody who has old stock should apply to our office indicating the kind of products and the number, then we will come and verify and give you the Tax Stamps free to affix on them.”

He therefore warned dealers in excisable products against accepting those that have no Tax Stamp on them from their distributers, and warned them: “When we come back to see such products, you will be arrested and prosecuted according to the law”.

The Tax Stamp Policy, which emanates from the Excise Stamp Act passed by Parliament in 2013, Act 873, prescribes that all alcoholic and non-alcoholic carbonated beverages, bottled water, cigarettes and other tobacco products are embossed with the Tax Stamp before being released to the market or sold to customers.

The Excise Tax Stamp is a specifically designed stamp with digital and other security features, which is supposed to be affixed on specified excisable products produced locally or imported, to provide enough guarantee of product authenticity as well as show that taxes and duties have been paid or will be paid.

This is to control the importation and local production of excisable goods for revenue purposes; check the illicit trading, smuggling, and counterfeiting of excisable products; check the under-declaration of goods, and protect and increase revenue mobilization for national development.

To ensure this, a deadline of six months was given to all distributors, wholesalers, and retailers, starting on March 1, 2018, to have the Tax Stamp affixed on their products.

Click to view details

Business News of Wednesday, 9 November 2022

Source: www.ghanaweb.com