Deputy Minister of Trade and Industry, Robert Ahomka-Lindsey, on October 16, 2018, said his outfit will introduce textile tax stamps to revive the ailing sector.

This, he said, will also curb smuggling, design piracy and tax evasion.

Read the full story originally published on October 16, 2018 by thebftonline.com.

Effective mid-November this year, all textiles — both locally made or imported— will have to be affixed with a specially designed tax stamp sticker before they could be traded on the market as a measure to block avenues for smuggling, design piracy and tax evasion.

According to a Deputy Trade and Industry Minister, Robert Ahomka-Lindsey, this intervention has become very critical to help save the ailing textiles industry while ensuring that all taxes on those items have been secured by the government.

Speaking to journalists at a sensitization event for top Customs officers and a section of the textiles dealership in Denu, near the Aflao border in the Volta Region, he said: “As a government, if we are keying on industrial transformation, one of the most obvious areas that we have the competitive advantage is in the design or textile manufacturing industry.

We are not against importation but when you do import the textiles, you have to pay the taxes on them so government can get revenue to develop the country and at the same time, help build businesses.”

He added: “We are looking to address a number of issues: encourage local manufacturing of textiles, inspire people to buy made in Ghana and stop the piracy of designs.”

The tax stamps to be affixed on textiles comes in two different colours—one for Ghana-made textiles and the other for imported ones, with a 2D scannable code that gives real-time feedback to Customs concerning tax compliance or tells the genuineness or otherwise to the buyer.

Textiles dealers or buyers without a smartphone can scratch the sticker to reveal a secret code that will have to be sent to a toll-free number to access the same details on the textile product.

In the late 1980s, the textiles industry employed about 30,000 people but the sector now has a current workforce of about 1,200.

This has been the outcome of sustained challenges in the industry such as smuggling, pirating of designs and under-invoicing/under-declaration.

“We know that there is a huge challenge with the textiles sector; for instance, I’m reliably informed that in 2017, only one container was officially cleared for tax in this country.

This is clearly not possible because we know that over 70percent of textiles that we buy in this country are not manufactured here,” Mr. Ahomka-Lindsey noted.

Also linked to this directive is the move to position the Tema Port as the single entry point for all textiles that are imported to the country.

This means that textiles imports will be placed under a “single window”, which according to the deputy trade minister, will bring “sanity” to the process.

“About 70 percent of all the textiles we use will have to be imported; so we are not saying we are against imports, far from it. But we are putting it through a single window as a way of bringing sanity to the current situation.

We’ve got to bring some processes back in place; the last time we introduced the single window, it worked very well but we need to bring some discipline into how we are doing things,” he indicated.

Sensitisation and grace period for traders

The Ministry of Trade and Industry (MoTI) is currently engaging various stakeholders in the textiles business—manufacturers, importers and traders on the tax stamp directive.

After Aflao, the ministry will be having similar exercises in Takoradi, Kumasi, Tamale and Accra to ensure the smooth implementation of the textiles tax stamp regime.

Mr. Ahomka-Lindsey said: “We are giving ourselves a little bit of time because we want to make sure that we have fully sensitized everybody; we are looking to spend time with everybody—retailers, importers, manufacturers and also consumers.

Over the next two to three weeks, we are sensitizing the stakeholders, getting feedback. At the end of the day, we want to give power to the consumers to make the right choice and in our hope that the programme will be kick-started effective November 15.”

Traders with old stock of textiles on the market before the exercise starts will have the tax stamp affixed on their products for free.

After that, they will be given a three months grace period to sell them off, after which the enforcement of the law will start.

Watch the latest edition of BizTech below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Business News of Monday, 16 October 2023

Source: www.ghanaweb.com

FLASHBACK: Textiles tax stamp to revive ailing sector - Ahomka-Lindsay

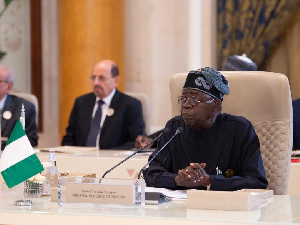

Deputy Minister of Trade and Industry, Robert Ahomka-Lindsey

Deputy Minister of Trade and Industry, Robert Ahomka-Lindsey