A report by the Parliamentary Committee on Roads and Transport has shown that government still owes road contractors more than GH¢3.69billion from projects financed from the consolidated and road funds.

The report on Annual Budget Estimates of the Roads and Highways Ministry for 2019, released in December 2018, showed that government had paid GH¢2.2billion to clear part of the debt owed contractors, but a large part remains unpaid while interest accumulates on it.

The outstanding debt means that contractors are unable to service credit facilities they may have taken from their banks or other financial institutions to get the work done. The unpaid bank loans have the potential to pile stress on the said financial institutions as well as the firms involved.

“The Committee found the accumulation of arrears in the debt payment to contractors worrisome. It also noted that delay in payments attracts payment of interest,” the report said.

Payment of interest on payment certificates unduly delayed is one of the compensation modes provided in contracts to protect the capital investment of contractors and sustain their cost of financing, the Parliamentary committee stated.

“For contractors to maintain their arrangements with creditors or renegotiate for continuous supply of requisite inputs and ensure project completion, government should ensure early payment to contractors.

“Undue delay of the employer in honouring payments due contractors has compelled contractors to claim interest as per the conditions of contracts, resulting in huge amounts,” the Parliamentary committee added.

Budget for 2019

The Roads and Highway Ministry is expected to be allocated GH¢1.29billion for its planned programmes in the 2019 fiscal year, with more than 30 percent of the allocation expected to go into capital expenditure.

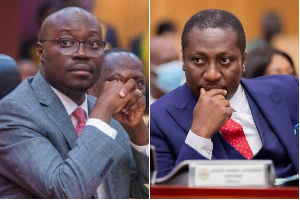

Speaking at the Value for Money Conference in June, 2018, Senior Minister Yaw Osafo-Maafo expressed worry over the cost of delayed payments to the public purse.

He said delays cost the nation huge sums of money through cost overruns and payment of high interest rates on projects.

‘‘Mr. Minister of Finance, if you were to think through how much delays in payment has cost us, it’s phenomenal,” he lamented.

‘‘Our interest rate has been hovering around 25 percent, and so if you borrow US$10million dollars equivalent on cedis at 25 percent the cost of money is GH¢2.5million dollars per annum.

“Assuming the money is available and they delay in its processing between the Minister of Education and Minister of Finance for one month, you’re adding one-12th of the US$2.5million, which is GH¢208,000, depending on which currency you’re dealing with.”

Business News of Monday, 21 January 2019

Source: thebftonline.com