Customers of the embattled gold dealership firm Menzgold Ghana Limited have been warned against accepting any form of land deal being offered by Nana Appiah Mensah, Chief Executive of the defunct company.

This comes after Nana Appiah Mensah also known as 'NAM1' while recounting the losses made, following the shutdown of MenzGold in September this year tweeted, “12th September 2018 in retrospect, we’re pained by the many losses we count”

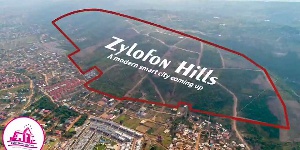

“Refreshingly, we celebrate many successes. We commemorate today with over 4,000 plots ENVISIONED new smart city coming up. As a goodwill gesture, 500 residential plots are reserved for MenzGold customers” the tweet added.

But in a reaction to the move, Chairman of the Coalition of Aggrieved Customers of Menzgold, Isaac Nyarko told the Citi Business News the deal offered was just another scam by the Menzgold Chief Executive.

“We want to warn all customers to stay away from this NAM1 [Nana Appiah Mensah] land issue. Because if you go for the land, tomorrow you never know which land guards will come after you, with claims of lack of payment by the one who sold the land to you. Moreover, we hear that the portion of land being offered is in a waterway, meaning it’s not good for settlement,” he cautioned.

“Please customers, be patient. Let’s push the government to liquidate the assets of NAM1 and then get us our monies. Zylofon is still working, NAM1 has got his houses, cars, so if government is serious with our plight, it will show commitment to get these assets liquidated, so we get paid,” Nyarko is quoted by Citi Business News.

Meanwhile, defunct Menzgold Ghana Limited since 2018 has been unable to pay its customers their invested funds following a directive by Securities and Exchange Commission (SEC) to suspend operations of the company after some breaches.

Shortly after, the SEC ordered the shutdown of the gold-trading firm across the country on September 12, 2019 and directed the company to desist from taking new investments.

The company was also directed to refrain from publishing or broadcasting commercials and advertorials on its related activities.

Business News of Friday, 13 November 2020

Source: www.ghanaweb.com