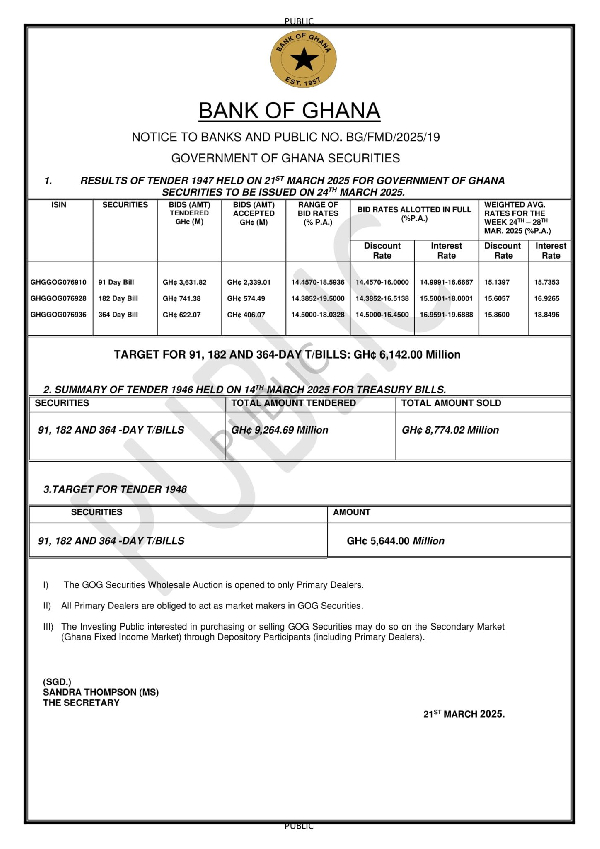

Ghana’s short-term debt auction has recorded an under subscription, with bids falling short by 45.9% equivalent to GH¢2.82 billion for the first time in several weeks.

At last Friday’s auction on March 21, 2025, the government received total bids worth GH¢4.99 billion against a target of GH¢6.14 billion.

Of this, GH¢3.31 billion was accepted, reflecting a measured approach to debt issuance amid changing market dynamics.

The 91-day bill saw the highest demand, attracting GH¢3.63 billion in bids, of which GH¢2.33 billion was accepted.

The 182-day and 364-day bills recorded bids of GH¢741 million and GH¢622 million, with the government accepting GH¢574 million and GH¢406 million, respectively.

Yields on the 91-day bill declined by 13 basis points to 15.73%, while the 364-day instrument fell by 12 basis points to 18.84%.

However, the yield on the 182-day bill remained unchanged from the previous auction.

The auction results come as the government prepares to raise an additional GH¢5.64 billion at its next short-term debt sale scheduled for March 28, 2025.

The decline in yields suggests improving investor confidence in Ghana’s macroeconomic outlook, though the under subscription signals cautious sentiment in the fixed-income market.

SP/MA

Watch the latest edition of BizTech below:

Click here to follow the GhanaWeb Business WhatsApp channel

Business News of Monday, 24 March 2025

Source: www.ghanaweb.com