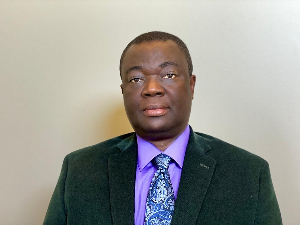

Economists, Dr Adu Owusu Sarkodie, says government must focus on getting the interest rates charged by financial institutions to drop to a single digit.

Ghana has over the period witnessed high-interest rates, despite the marginal reduction in the past few years.

He believes that a high-interest rate is a disincentive to the private sector which is the engine of growth for the country.

Speaking on GhanaWeb’s BizTech show, Dr Adu Sarkodie said a single-digit interest rate would be the decisive breakthrough for the private sector.

"The interest rates in Ghana are still relatively high. We are still in double digits interest rates in Ghana whereas what the Ghanaian private sector is looking at is single-digit rates of interest.

"The entrepreneurial capacity and capabilities of the Ghanaian is no longer an issue."But where does the entrepreneur turn to for the 50, 100, 200,000 dollar initial support? He goes to microfinance institutions who are taking not just an arm and a leg but both arms and legs in terms of interest rates" he said.

The economist also indicated that a single-digit interest rate would help the agricultural and industrial sectors to expand and create more jobs for Ghanaians.

He, however, charged the government to ensure fiscal rectitude for a robust economy.

The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) is scheduled to from today September 22, 2020, to Friday, September 25, 2020, hold its regular meetings.

The Committee is also expected to announce the Monetary Policy Rate which is of keen interest to businesses as it influences the interest rate on loans and determines the rate at which the central banks lend to commercial banks.

At its 95th meeting in July this year, the central bank kept its monetary policy rate unchanged at 14.5 percent with the Governor of the Central bank, Dr Ernest Addison attributing the verdict to disruptions in the economy triggered largely by the COVID-19 pandemic.

Business News of Sunday, 27 September 2020

Source: www.ghanaweb.com

Target single digit interest rate - Economist to government

Entertainment

Amakye Dede to mark 50 years anniversary with world tour

Opinions