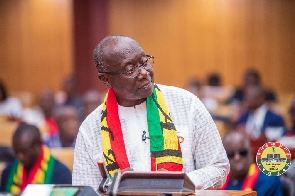

Finance Minister, Ken Ofori-Atta, took a swipe at some professionals, lawyers, doctors, and accountants, who do not honour their tax obligations.

Ken Ofori-Atta said, “Through technology, therefore, we can find a means of ensuring that everybody contributes to this national reconstruction [economic recovery] that we have to do and recognise that this is the moment in our history, and to tackle these issues. Will it be uncomfortable? Of course, it will be uncomfortable. But where is the shared burden for us to move across? he asked.

“So, I listen to social media and then I look at the statistics. Since we brought the national ID [Identification Card] to the Ghana Revenue Authority, I can find some 60,000 of the people who live in my nice neighbourhood [Labone, Cantonments etc.] – accountants doctors, lawyers – who always blame the informal sector- masons etc. And these 60,000 people are paying nothing and they have been able to convince you that E-Levy is bad because it’s a tax on tax etc”, he added.

Read the full story originally published on November 26, 2021 by GhanaWeb

Government introduces a 1.75% tax on all electronic transactions

Government to rake in money from E-Levy

60,000 professionals do not pay their taxes, Ofori-Atta

Finance Minister, Ken Ofori-Atta, has tongue-lashed some professionals, lawyers, doctors, and accountants, who do not honour their tax obligations.

He said he's amazed at how these professionals have been able to convince the informal sector to 'reject' the newly introduced e-levy in the 2022 budget.

Speaking at the TUC Economic Dialogue on the 2022 budget, Ken Ofori-Atta said, the introduction of the 1.75% levy on all electronic devices is a way to get everyone to contribute their quota towards the recovery of the local economy.

He said about 60,000 professionals have been highlighted in the Ghana Revenue Authority (GRA) as persons who do not pay tax.

Ken Ofori-Atta said, “Through technology, therefore, we can find a means of ensuring that everybody contributes to this national reconstruction [economic recovery] that we have to do and recognise that this is the moment in our history, and to tackle these issues. Will it be uncomfortable? Of course, it will be uncomfortable. But where is the shared burden for us to move across? he asked.

“So, I listen to social media and then I look at the statistics. Since we brought the national ID [Identification Card] to the Ghana Revenue Authority, I can find some 60,000 of the people who live in my nice neighbourhood [Labone, Cantonments etc.] – accountants doctors, lawyers – who always blame the informal sector- masons etc. And these 60,000 people are paying nothing and they have been able to convince you that E-Levy is bad because it’s a tax on tax etc”, he added.

On November 17, 2021, Finance Minister, Ken Ofori-Atta, during the 2022 budget reading in parliament, announced the introduction of 1.75% tax on all electronic transactions.

According to him, this new directive forms part of strategies to widen the country’s tax net.

He added that the 1.75% tax is also to enhance financial inclusion and protect the vulnerable in the country.

Though this e-levy has received public backlash, the Finance Minister, Ken Ofori-Atta, has said government will find a way to win the cooperation of the Minority in parliament to accept the e-levy.

Watch the latest episode of BizTech below:

Click to view details

Business News of Friday, 25 November 2022

Source: www.ghanaweb.com

Today in History: You don't pay your taxes yet complain about E-Levy - Ofori-Atta to lawyers, doctors

Opinions