Business News of Monday, 26 February 2024

Source: www.ghanaweb.com

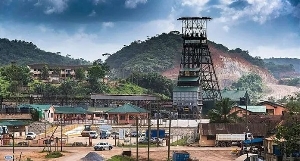

Bogoso-Prestea gold mine to recapitalize over legacy debts

The owner and operator of Bogoso and Prestea mining leases, FGR Bogoso Prestea Limited, has signed an agreement seeking to recapitalize the mine as part of a planned restructuring of its ownership.

In a statement issued on Monday February 26, 2024, the operator [Future Global Resources] said the move is aimed at supporting the long-term success of the mine adding that the transaction is subject to approval by the Ministry of Lands and Natural Resources.

“These issues are now expected to be addressed by restructuring the ownership of the mine to bring in additional financing and bring the important asset back to full operations,” the company said in a statement.

Executive Chairman of Future Global Resources, Andrew Cavaghan speaking on the new developments said “the Bogoso Prestea Gold Mine has the potential to be a Tier 1 gold producing asset.

“We believe this transaction enables us to unlock this potential, delivering a multi-generational and sustainable business for our shareholders, our workforce, and the whole community,” he added.

The Bogoso Prestea mine has a proud history dating back to 1912, during which time it has produced over 9m ounces of gold.

However, since 2017, it has been suffering from declining performance, racking up over $200 million of losses, much of which is owed to local suppliers, government agencies and its workforce.

This led to the introduction of a new owner, Future Global Resources (FGR), in October 2020, which has invested considerable sums over the past three years to help cover these losses as well as working with the local team to change the mining method underground and reopen surface mining.

However, the legacy debts, which pre-date the ownership of FGR, along with unstable industrial relations, have undermined the mine’s ability to attract the further investment it needs to stabilise and grow profitable production.

MA/NOQ

Watch the latest edition of BizHeadlines below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Click here to follow the GhanaWeb Business WhatsApp channel