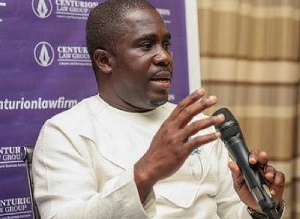

The Global Head of Financial Markets at the Standard Chartered Bank, Jonathan Paul, has said that Ghana’s extended facility programme with the International Monetary Fund (IMF) has started setting the economy on the path to recovery.

According to Mr. Paul, the recent relative stability in the exchange rates is a visible sign that Ghana’s three-year deal with the IMF is achieving its purpose of restoring macroeconomic stability in the country.

“In terms of the IMF’s involvement as a market practitioner, obviously it is a very positive step…stability in the cedi has been important for the economy in the last six months. What is happening this year is that the US dollar is down by 8.5 percent against the basket of currencies since it started at the beginning of the year,” he said.

Mr. Paul said this at a press briefing organised in Accra to analyse the impact of shocks in the global economy on the local economy.

The International Monetary Fund (IMF) recently completed its third review mission to Ghana and concluded that the country as at the end of December 2015 had broadly met the performance criteria under its three-year Extended Credit Facility (ECF) programme.

Additionally, the year-end 2015 fiscal deficit of 6.7% of GDP in cash terms surpassed the budgeted 7.0% target and marked a significant improvement from the 9.4% deficit reported in 2014; and the country’s fiscal consolidation efforts included larger-than-expected arrear repayments.

Still analysing the local economy, Mr. Paul further said that even though he does not subscribe to using tight monetary policy as the best way of tackling inflation, he is hopeful that approach (tight monetary policy) by the central will soon result in a decline of inflation; thereby compelling the Bank of Ghana to reduce the policy rate and make cost of credit affordable in the country.

“Inflation is probably going to remain a little challenging for the short-term, but it will start to respond to the relatively tight monetary policy the central bank has adopted; and once inflation starts to come down, then the expectation is the central bank will start to lower interest rates in order to stimulate growth,” he said.

He however urged government to build a resilient manufacturing sector in order to prevent another economic slump once the economy settles down, adding that government can do so if producers have access to power at a reasonable cost.

“I believe strongly that in the medium-term, for the manufacturing sector to continuously expand, particularly goods which are consumed domestically should be produced domestically. A critical first step to that is a stable power sector.

“There needs to be a focus on building the manufacturing sector because the country is still import-dependent now, and a key factor is that there needs to be a reliable source of power at a reasonable price that allows businesses to compete with imports,” Mr. Paul said.

Furthermore, he encouraged government to continue showing strong commitment to the programme in order to reward citizens after going through torrid times under the IMF programme.

“Once structural reforms have been undertaken in the Ghanaian economy, things will get better in it and there is no way going back. And the people will realise that once there is short-term pain in reforming the economy, there is long-term gain from employment, stability in the currency and growth,” he said.

Business News of Monday, 30 May 2016

Source: B&FT

IMF programme yielding good results - Financial Analyst

Entertainment