Business News of Tuesday, 6 June 2023

Source: www.ghanaweb.com

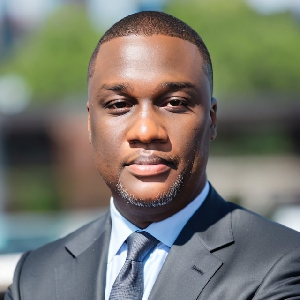

Revocation of banks licenses due to breach in regulations, not politics - Financial Analyst

Financial Analyst, Dr Samuel Dawson, has squashed claims that the collapse of some financial institutions in 2017 was based on political reasons.

According to him, the financial system at the time was on the brink of collapse due to bad governance from heads and directors of those financial institutions.

Dr Dawson stressed that most of the local banks that were collapsed breached several banking regulations.

Speaking in an interview with 3news, the financial analyst said, “I can tell you that, most of the local banks breached several banking regulations. They had governance issues. You had a situation where loans were given to family and friends without proper documentation. Depositors' funds were diverted to build businesses of shareholders. Some depositors were not getting back their funds from some of the financial institutions.”

“In fact, the financial system at the time was on the brink of total collapse,” he added.

His comments come after renowned economist, Kwame Pianim, and other political commentators said some banks were collapsed due to political reasons and the licenses of the affected banks need to be restored.

It would be recalled that in 2017, the Bank of Ghana undertook a clean-up exercise that saw the revocation of operating licenses of some 8 banks, 23 savings and loans companies and more than 400 specialised deposit-taking institutions (SDIs).

UT Bank, Capital Bank, Sovereign Bank, Beige Bank, Premium Bank, The Royal Bank, Heritage Bank, Construction Bank and UniBank, were the affected banks.

According to the Receiver for some of the financial institutions, preliminary investigations found that most directors of the defunct financial institutions failed in their fiduciary responsibilities to customers and other stakeholders.

The measures taken by the BoG safeguarded the investments of 4.6 million depositors.

Watch the latest edition of BizTech and Biz Headlines below:

ESA/FNOQ