The Ghana Revenue Authority (GRA) has said that ports and domestic businesses have realigned their figures to comply with implementation of the new Value Added Tax (VAT) rate.

The new effective VAT rate of 17.5 percent (standard rate plus insurance levy) has taken effect following the presidential assent given the VAT Act 2013 (Act 870) on December 30, 2013.

The tax now has an extended scope covering immovable property, the supply of financial services, domestic transportation of passengers by air and haulage, as well as rental of vehicles, business activities of auctioneers, businesses of gymnasiums and spas, and the manufacture or supply of pharmaceuticals.

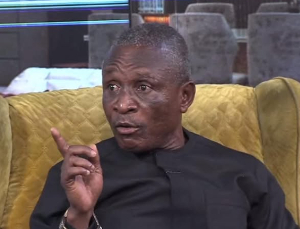

Mr. George Blankson, Commissioner-General of GRA, in an interview with the B&FT in Accra explained that a directive to the various taxpayers and collectors -- particularly at the country’s ports and the domestic fronts -- to implement the new rate has been issued to ensure compliance.

“Agents who collect the tax on our behalf settled on 8th January as the day that the tax took effect, particularly at the ports, and we have issued tariff interpretation orders that took effect from 8th January and have also issued all the directives for it to take effect on the domestic fronts.

“We’ve also been planning the implementation of the law, and therefore when the law received assent last week Friday, we immediately swung into motion to have it implemented -- allowing for the convenience of the taxpayers and tax collectors,” Mr. Blankson said.

Parliament in November 2013 approved the increase in standard VAT from 12.5 percent to 15 percent, while the National Health Insurance Levy remained at 2.5 percent. The approval by parliament was met with fierce resistance from minority MPs.

Finance Minister Seth Tekper in the 2014 budget statement explained that proceeds from the increment will be channelled into an infrastructure fund, which will take off in the first quarter of this year.

GRA in a release directed taxpayers who have been authorised by the Commissioner-General to use their own computer-generated invoices as well as electronic cash registers to re-programme their equipment and ensure that VAT is charged at the new rate.

The statement signed by Mr. Blankson said registered entities must use the GRA’s VAT/NHIL invoices, which should be adjusted to comply with the new rate in any instance where they are unable to use their computer-generated invoices or electronic cash register receipts.

The GRA statement reminded the business community that their tax returns should be submitted to the Commissioner-General on the last working day of the month, whether or not the tax is payable for the period.

It also stated that the allowable period for deducting input tax is reduced from three years to six months, adding: “All registered persons who are in possession of valid VAT/NHIL invoices for input tax claims which are more than six months old are to claim them on the December 2013 returns”.

Meanwhile, all businesses authorised to operate under the VAT flat rate scheme (VFRS) are required to charge and account for the tax at the rate of 3 percent of the taxable value of their supplies.

Business News of Monday, 13 January 2014

Source: B&FT

Businesses comply with new VAT rate