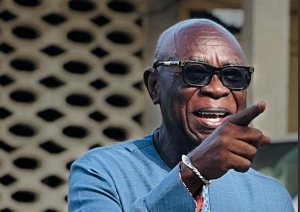

The Senior Minister designate, Yaw Osafo Marfo has said it was regrettable for the system to allow the Bank for Housing and Construction to collapse.

Mr. Yaw Osafo Marfo reiterated that the World Bank misled the country over the collapse of the facility because in his view, “the reasons assigned to the collapse of the bank were not tenable.”

The bank was liquidated following heavy losses, official sources said at the time.

The bank was closed down by the Central bank and the government because sources said, the liabilities of the bank exceeded its asset which affected its ability to satisfy the capital adequacy and minimum capital required under the banking law.

The country’s housing needs is in short supply of 1.7 million units, and is projected to climb to two million by 2018, analysts say.

The situation required the introduction of pragmatic and deliberate policies and private sector participation to raise supply in the sector.

Commenting on the growing Housing deficit in Ghana, during his vetting Friday, Mr. Osafo Marfo said:”We need a bank that can provide medium to long term funds to make the housing industry work.”

“You cannot use commercial bank funds to support housing and therefore we have to think through this again and see the best way forward…Mortgage financing is not medium term,It is long term. People should be paying between 10 to 25 years,” he said.

Mr. Osafo-Marfo is an engineer and a project analyst by training and he established his credentials as a banking and finance leader by heading and successfully restructuring two major Ghanaian banks, the Bank for Housing and Construction and the National Investment Bank between 1979 and 1992.

Business News of Friday, 20 January 2017

Source: kasapafmonline.com

World Bank misled Ghana in collapse of Bank for Housing & Construction – Osafo-Marfo

Entertainment