- Home - News

- TWI News | TV

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- News Videos | TV

- Photo Archives

- News Headlines

- Press Release

General News of Saturday, 10 June 2017

Source: kasapafmonline.com

$2.25 billion bond: We’ll still continue our queries – NDC MPs

The minority in parliament says it is still pursuing the controversial 2.25 billion dollar bond issue by the Akufo-Addo government to prove that the bond was not issued in the right manner.

It said the Finance Minister, Ken Ofori Atta failed to provide the House with full documentations as part of the requirement of the half-hour motion that dragged him to parliament this week.

Responding on the floor of parliament to the half-hour motion passed by Parliament on the bond issuance, Mr. Ofori-Atta told the House there were no breaches of integrity, either on Government’s part or on the transaction advisors’ part regarding the bond issuance.

“It would indeed be quite difficult to manipulate the process when there are three financial institutions of which two are international banks governed by strict Bank of Ghana rules and regulations.”

He told Members that the 15 and 7 year $2.25 billion bond with a coupon rate of 19.75% issued in April was done in a transparent manner.

The said bond, he added, was denominated and issued in Ghana Cedi, in accordance with the relevant laws of the West African nation.

“Mr. Speaker, like our previous bonds, these bonds were issued in a competitive and transparent bidding process, managed by our Joint Book Runners namely: Barclays, Stanbic and SAS, who were appointed in 2015.

As is the normal practice, since the book building process began in 2015, the Joint Book Runners announced the sale of the bonds, as per the 2nd quarter Issuance Calendar. Subsequently, primary dealers who are mostly banks mobilized interested foreign and local investors to participate in the sale,” he noted.

He added: “I want to state categorically that the bond was denominated and issued in Ghana Cedis. It should be understood that it was not a dollar bond. The advantage of opening it up to foreign investors is that they bring in their hard currency to purchase the bond in our local currency. This has the positive impact of helping to strengthen the cedi. The participation of foreign investors who brought considerable foreign exchange through their custodian banks has created the false impression to some that it was a USD bond.”

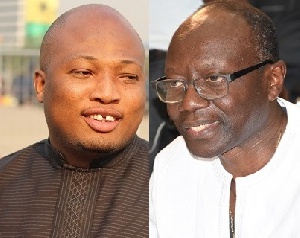

But Minority’s Spokesperson on Foreign Affairs and MP for North Tongu, Samuel Okudzeto Ablakwa said the Minister has still not been able to satisfy the queries raised on the bond issue, insisting it will go all out to prove its case on the matter.

“Unfortunately, when the Finance Minister appeared before Parliament, he did not satisfy all the questions we had asked of him in our half hour motion. Our half hour motion was very specific. We wanted full documentation.

As we speak, we do not have the prospectus. He did not submit the agreement that had been signed between the book runners, the government of Ghana and Franklin Templeton, we don’t have that agreement…so we will continue to pursue this matter,” he told Accra-based Citi FM.